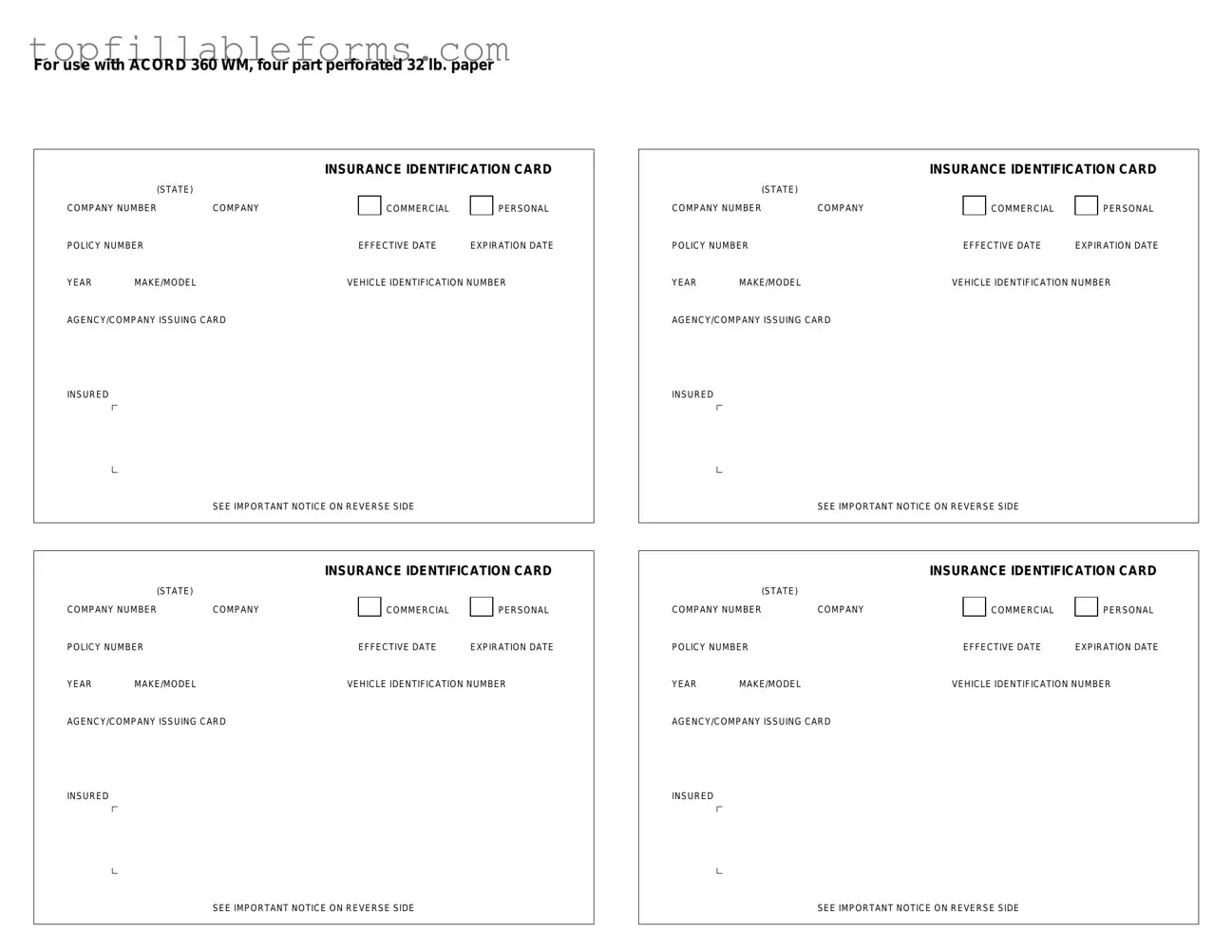

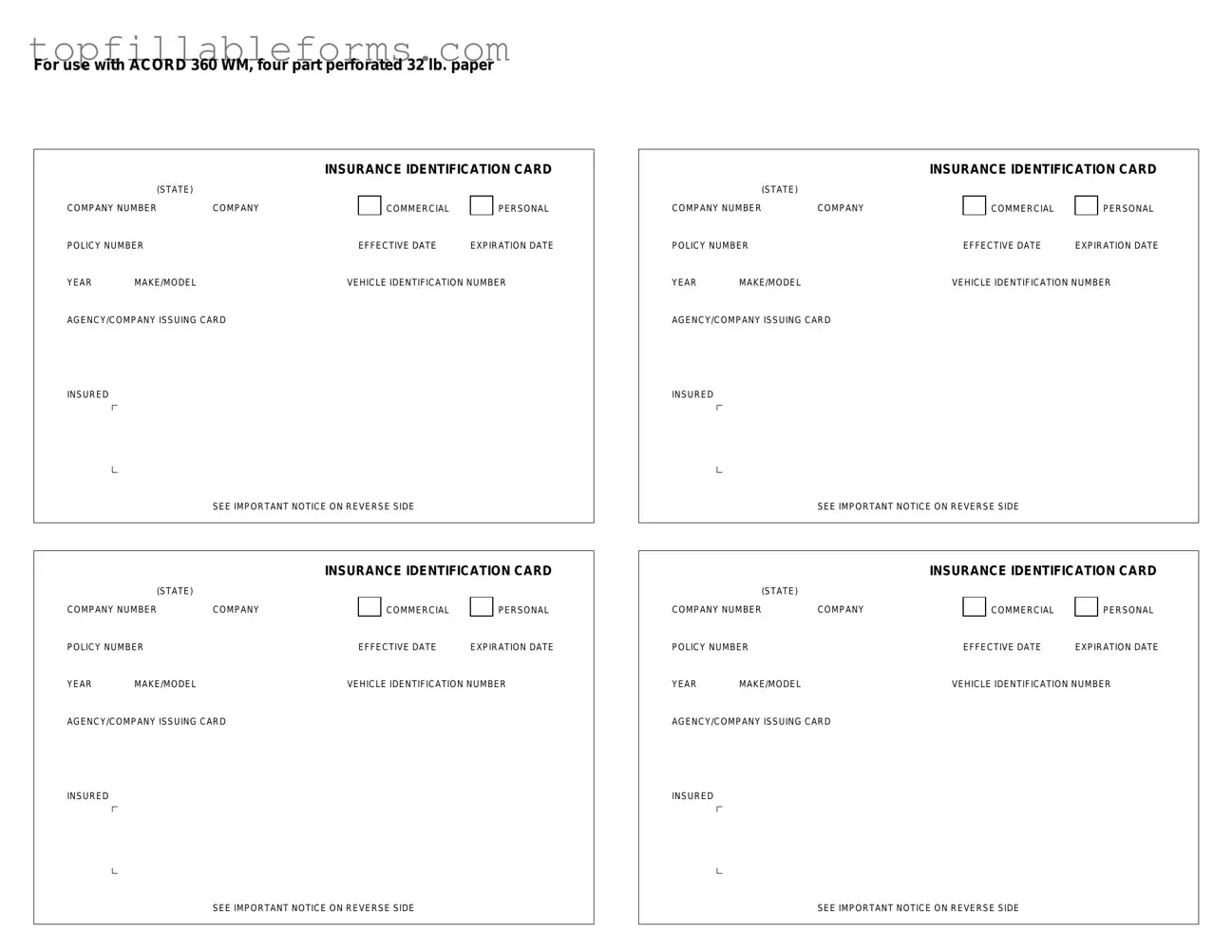

Printable Acord 50 WM Form in PDF

The Acord 50 WM form is a standardized document used in the insurance industry to provide essential information regarding workers' compensation coverage. This form serves as a vital tool for employers and insurers, ensuring clarity and compliance in the reporting process. Understanding its purpose and proper usage can significantly enhance communication between all parties involved.

Open Acord 50 WM Editor Here

Printable Acord 50 WM Form in PDF

Open Acord 50 WM Editor Here

Finish the form now and be done

Finish your Acord 50 WM online by editing, saving, and downloading fast.

Open Acord 50 WM Editor Here

or

▼ PDF File