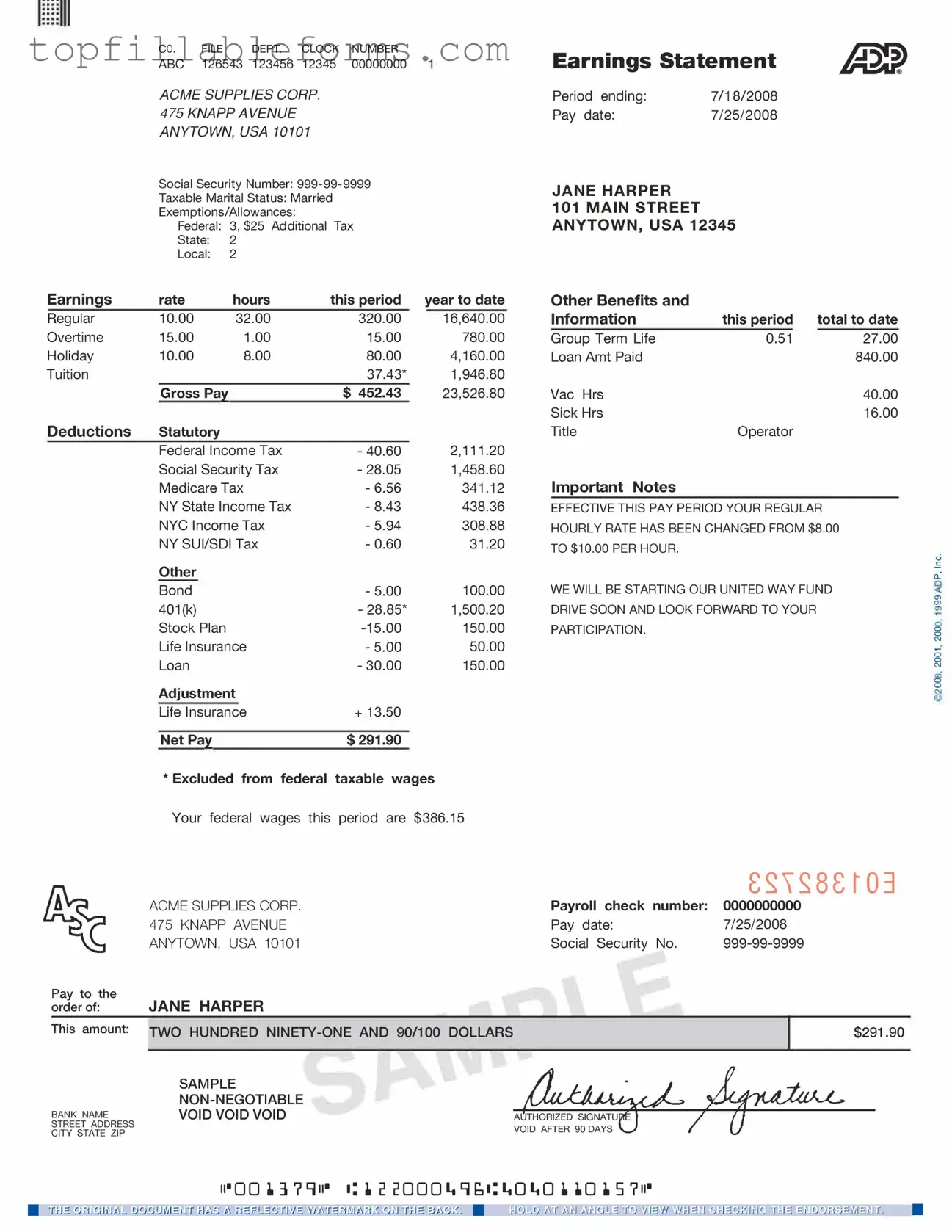

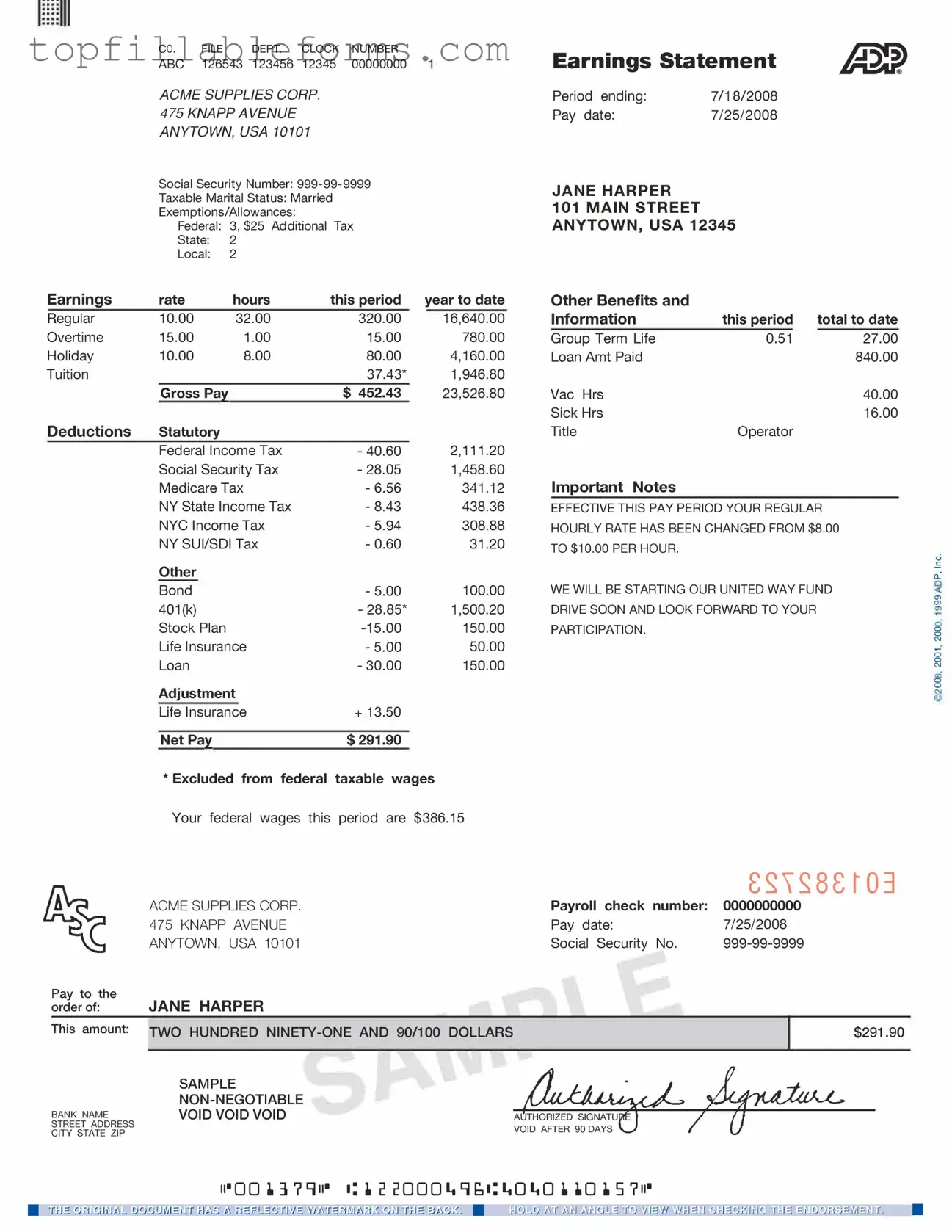

Printable Adp Pay Stub Form in PDF

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. This form is essential for understanding your paycheck, as it outlines gross pay, taxes withheld, and other deductions. By reviewing your pay stub, you can ensure accuracy and stay informed about your financial situation.

Open Adp Pay Stub Editor Here

Printable Adp Pay Stub Form in PDF

Open Adp Pay Stub Editor Here

Finish the form now and be done

Finish your Adp Pay Stub online by editing, saving, and downloading fast.

Open Adp Pay Stub Editor Here

or

▼ PDF File