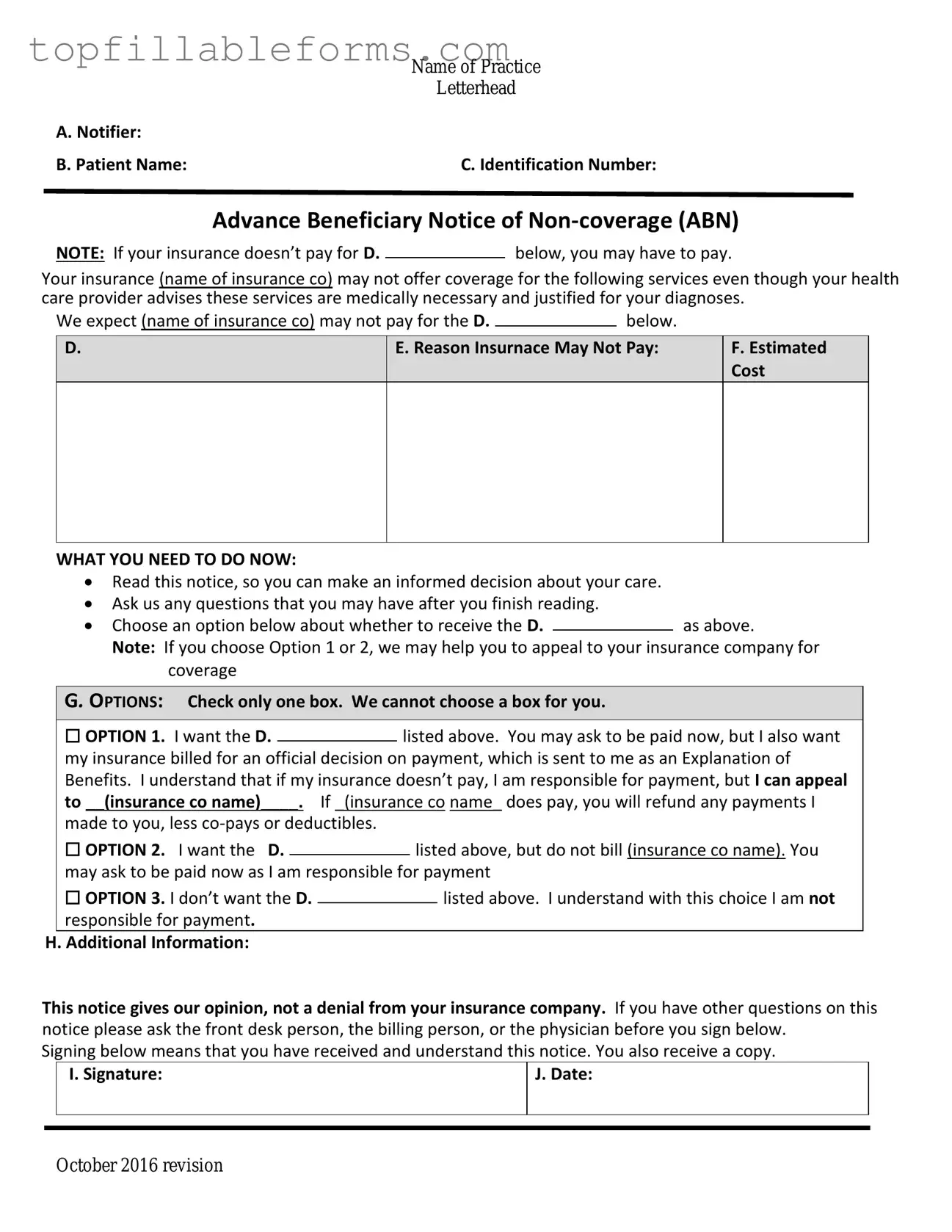

Printable Advance Beneficiary Notice of Non-coverage Form in PDF

The Advance Beneficiary Notice of Non-coverage (ABN) is a crucial document that informs Medicare beneficiaries when a service may not be covered. This form helps patients understand their financial responsibilities before receiving care. By providing clarity, the ABN empowers individuals to make informed decisions about their healthcare options.

Open Advance Beneficiary Notice of Non-coverage Editor Here

Printable Advance Beneficiary Notice of Non-coverage Form in PDF

Open Advance Beneficiary Notice of Non-coverage Editor Here

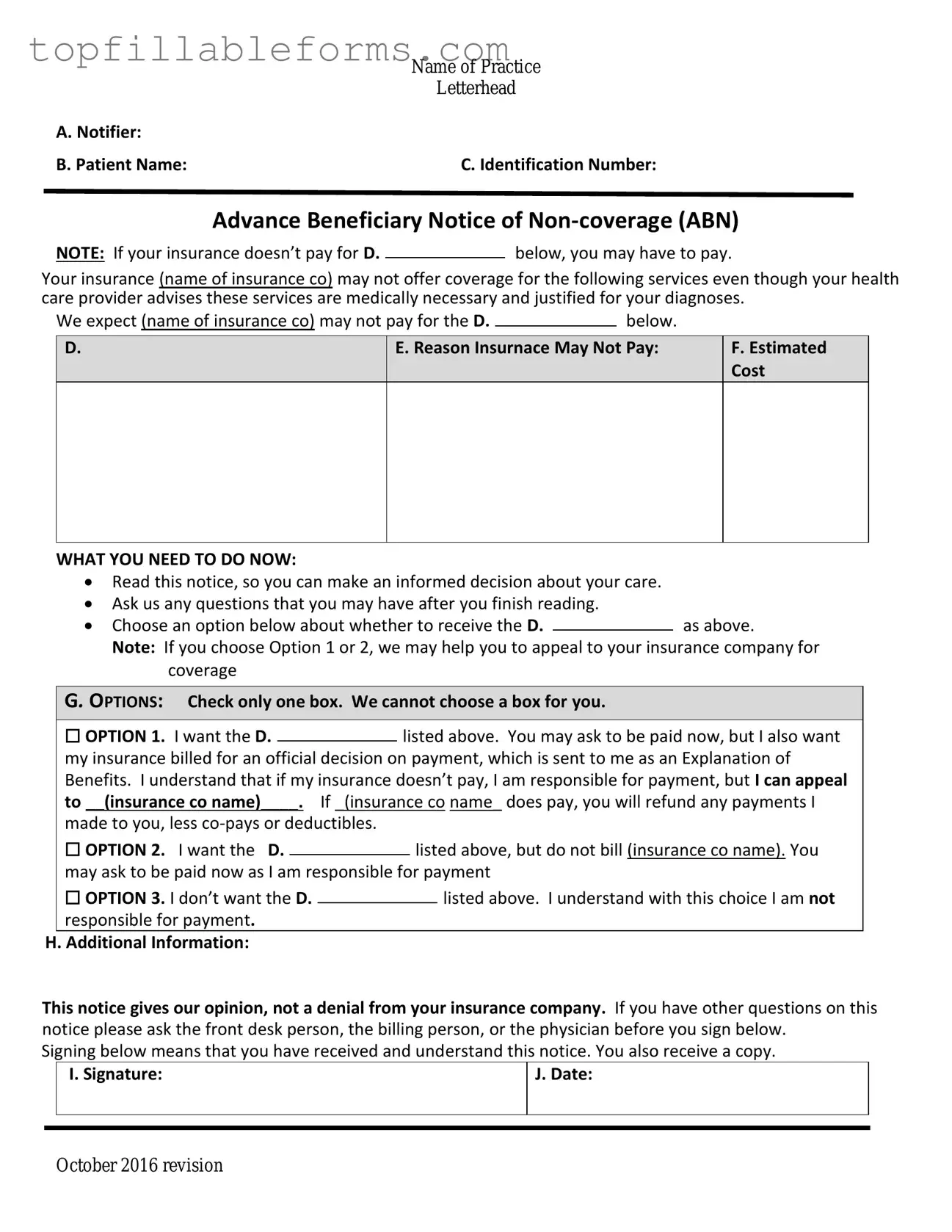

Finish the form now and be done

Finish your Advance Beneficiary Notice of Non-coverage online by editing, saving, and downloading fast.

Open Advance Beneficiary Notice of Non-coverage Editor Here

or

▼ PDF File