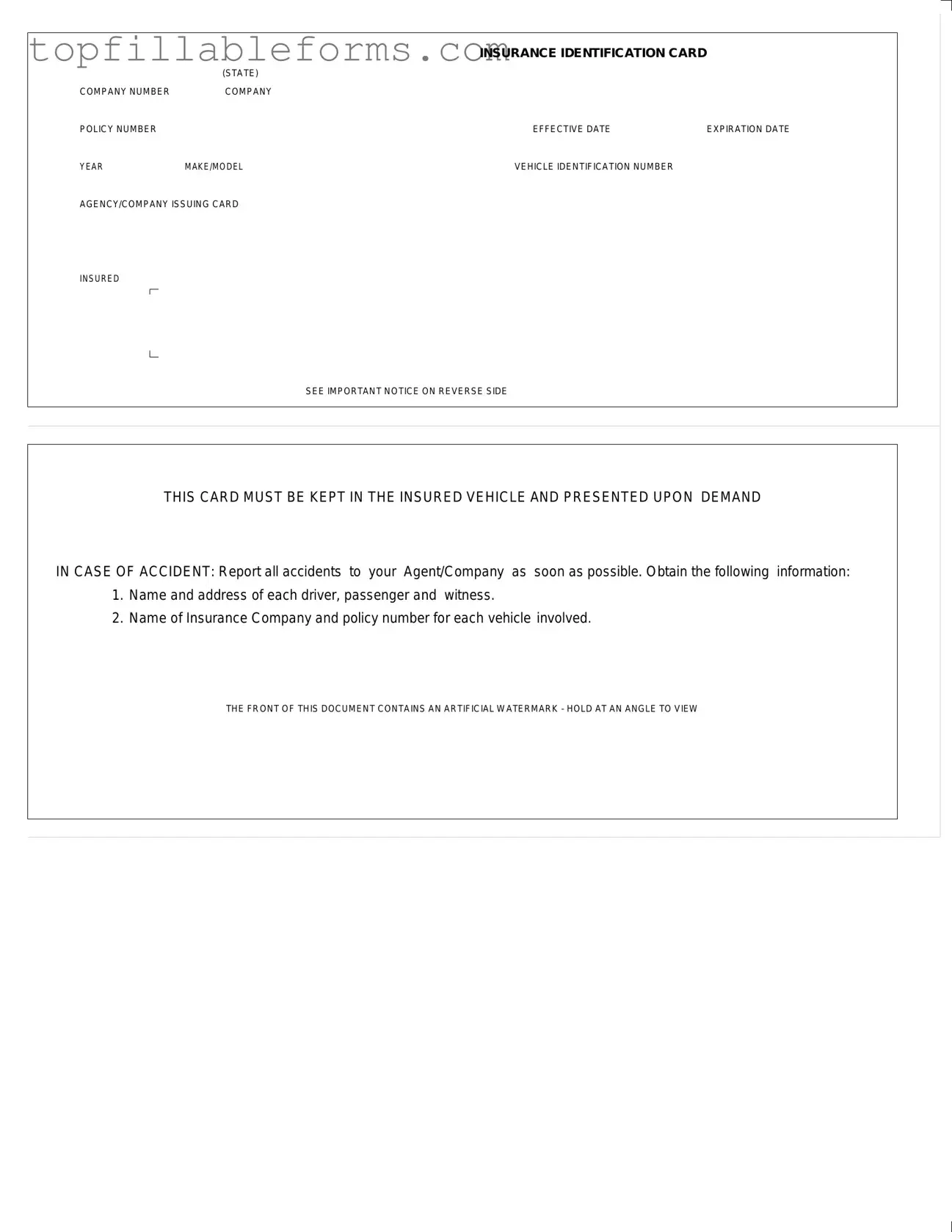

Printable Auto Insurance Card Form in PDF

The Auto Insurance Card is a crucial document that provides proof of insurance coverage for a vehicle. It contains essential information such as the insurance company name, policy number, and vehicle details, ensuring that drivers comply with state regulations. Keeping this card in your vehicle is important, as it must be presented upon request in case of an accident.

Open Auto Insurance Card Editor Here

Printable Auto Insurance Card Form in PDF

Open Auto Insurance Card Editor Here

Finish the form now and be done

Finish your Auto Insurance Card online by editing, saving, and downloading fast.

Open Auto Insurance Card Editor Here

or

▼ PDF File