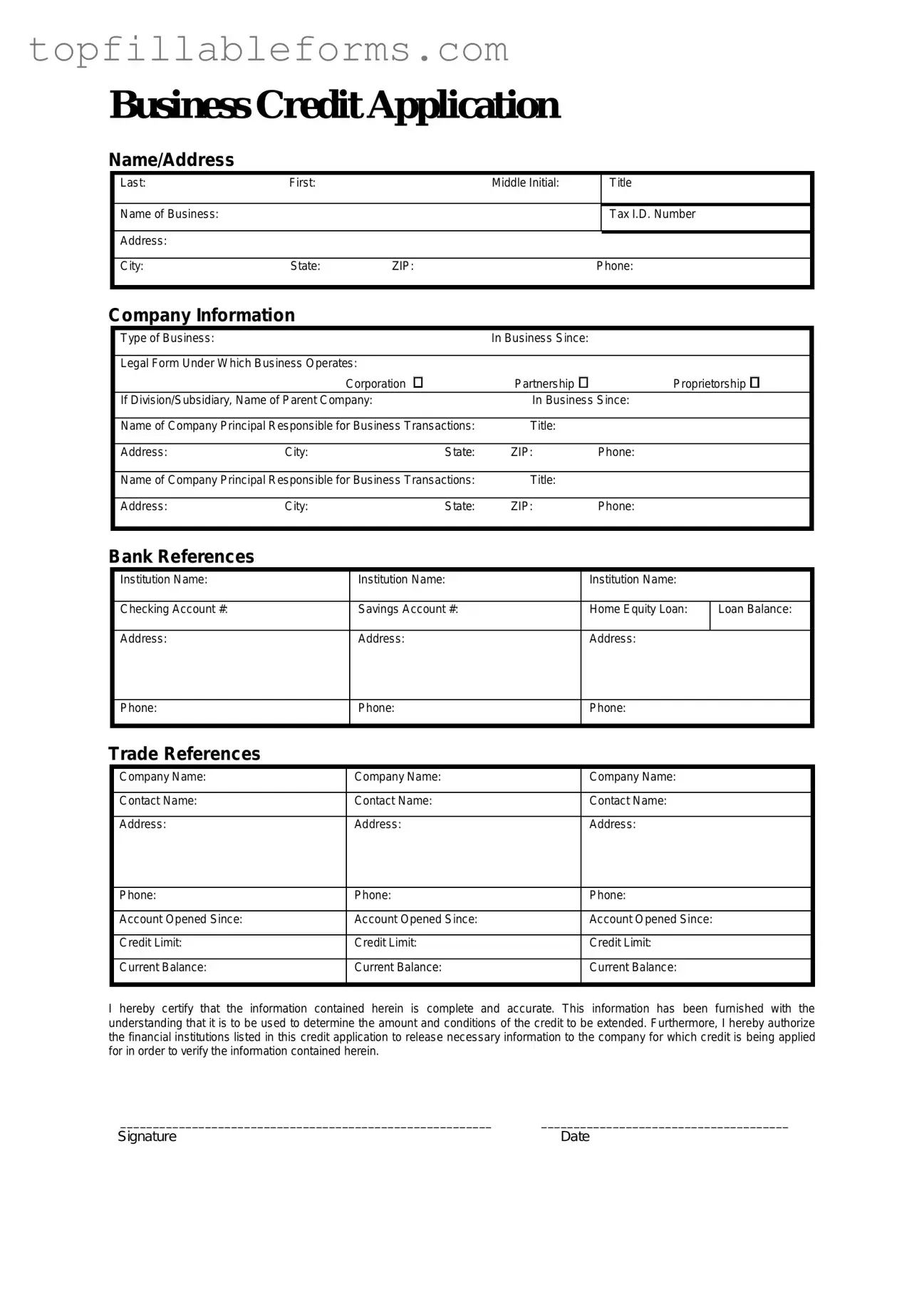

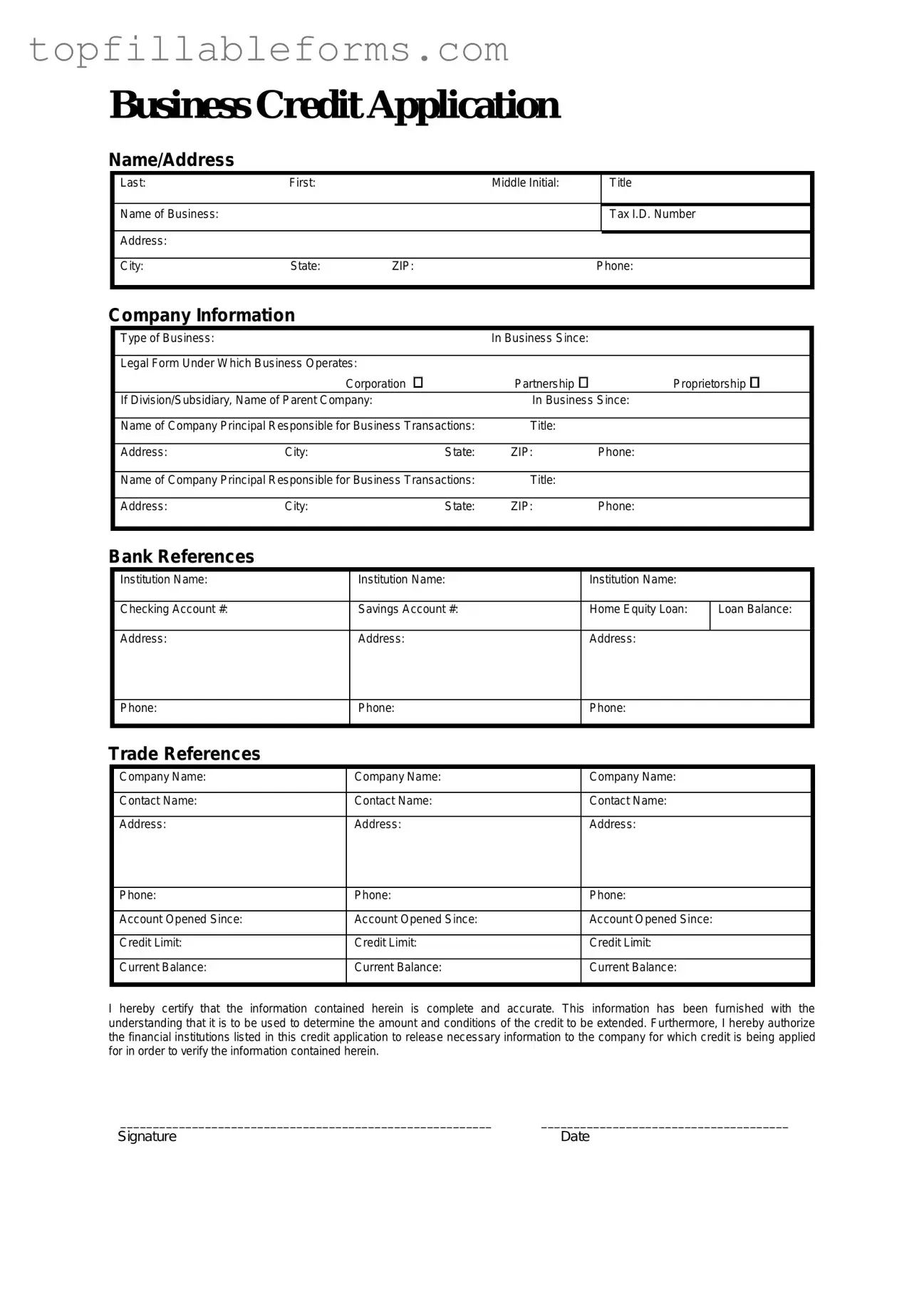

Printable Business Credit Application Form in PDF

The Business Credit Application form is a crucial document that allows businesses to apply for credit from suppliers or financial institutions. This form collects essential information about the business, including its financial history and creditworthiness. Completing it accurately can significantly impact a company's ability to secure the funding it needs to grow and thrive.

Open Business Credit Application Editor Here

Printable Business Credit Application Form in PDF

Open Business Credit Application Editor Here

Finish the form now and be done

Finish your Business Credit Application online by editing, saving, and downloading fast.

Open Business Credit Application Editor Here

or

▼ PDF File