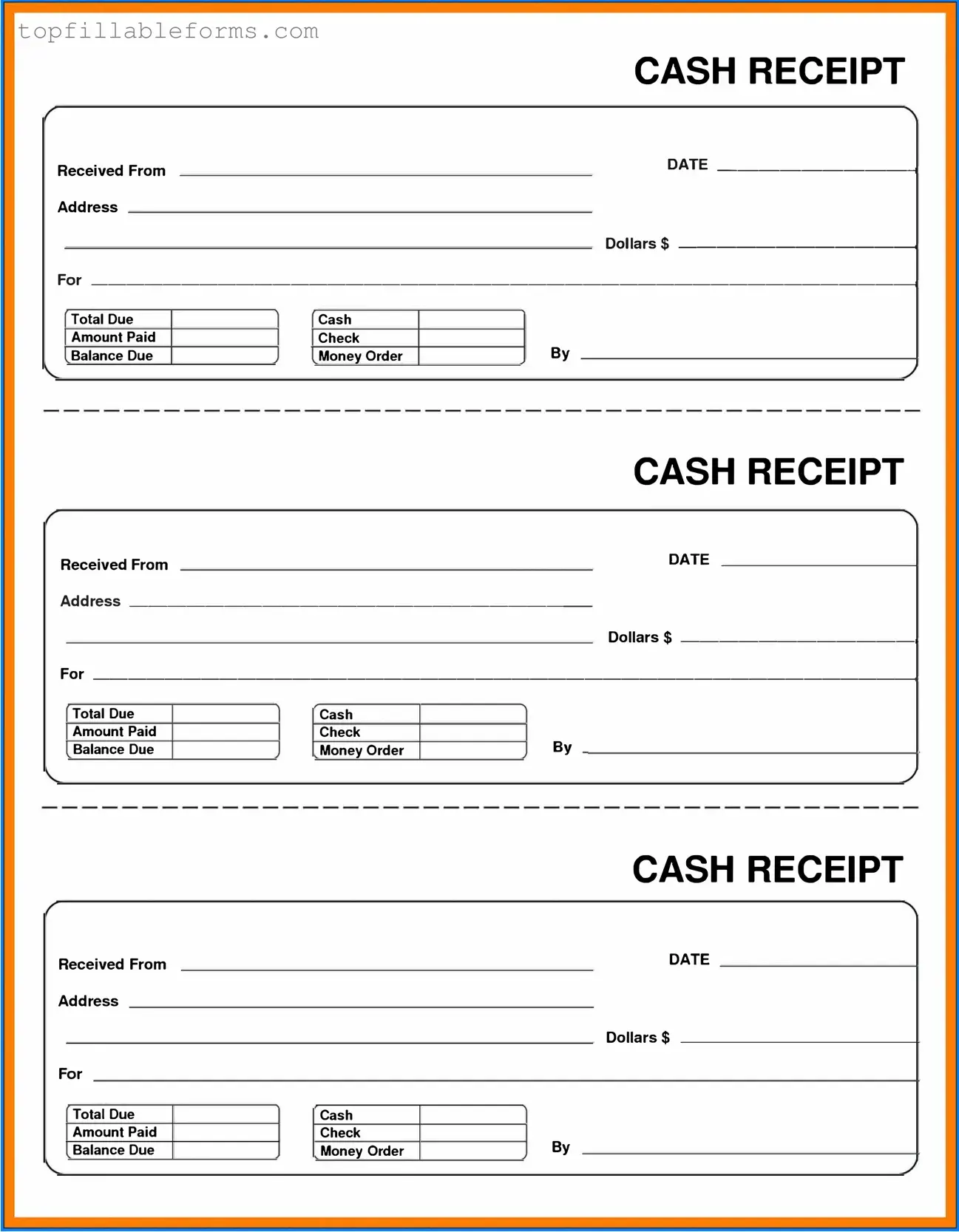

Printable Cash Receipt Form in PDF

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. This form serves as a record for both the payer and the recipient, detailing the transaction and providing proof of payment. It is commonly utilized in various business transactions to ensure accurate financial tracking.

Open Cash Receipt Editor Here

Printable Cash Receipt Form in PDF

Open Cash Receipt Editor Here

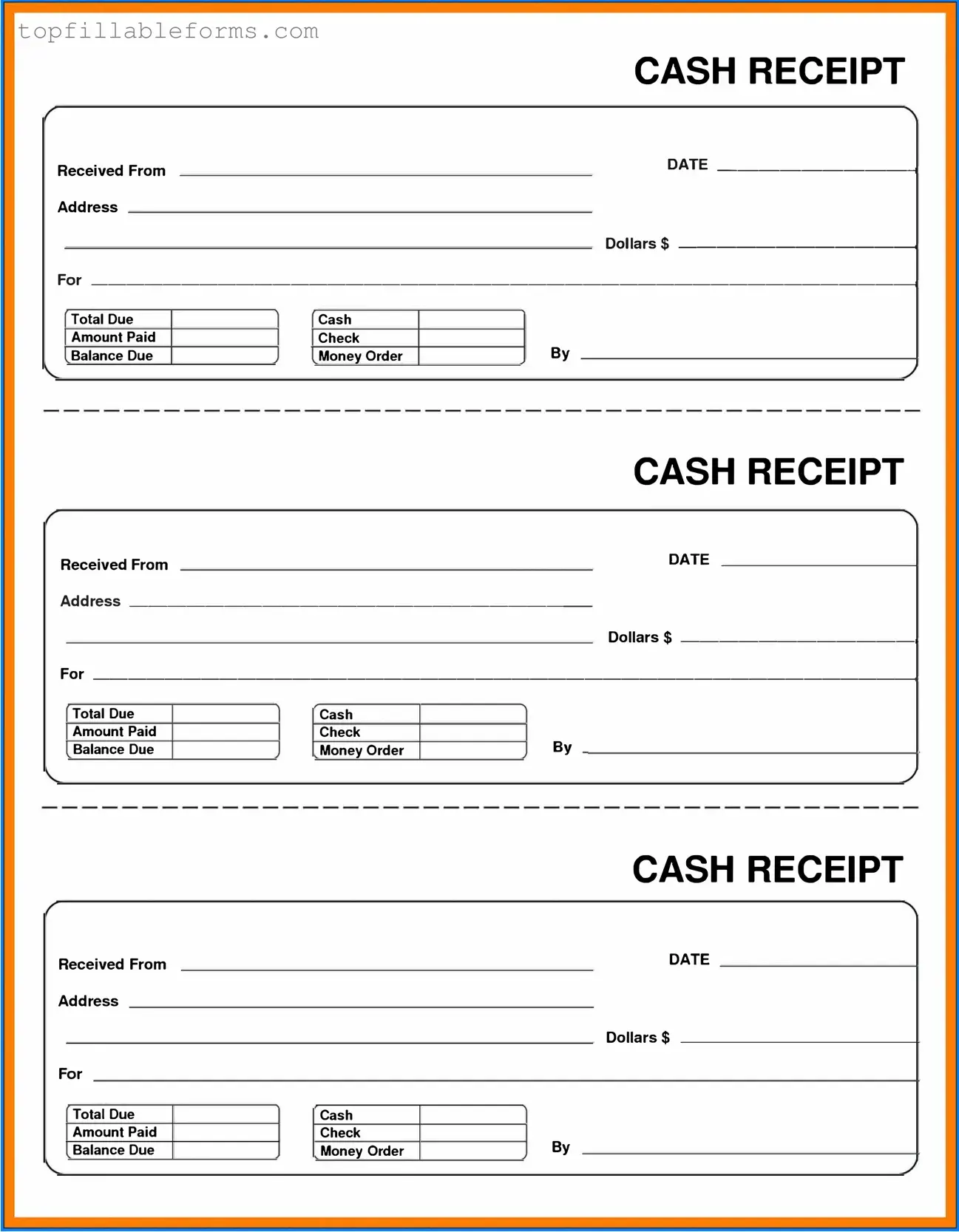

Finish the form now and be done

Finish your Cash Receipt online by editing, saving, and downloading fast.

Open Cash Receipt Editor Here

or

▼ PDF File