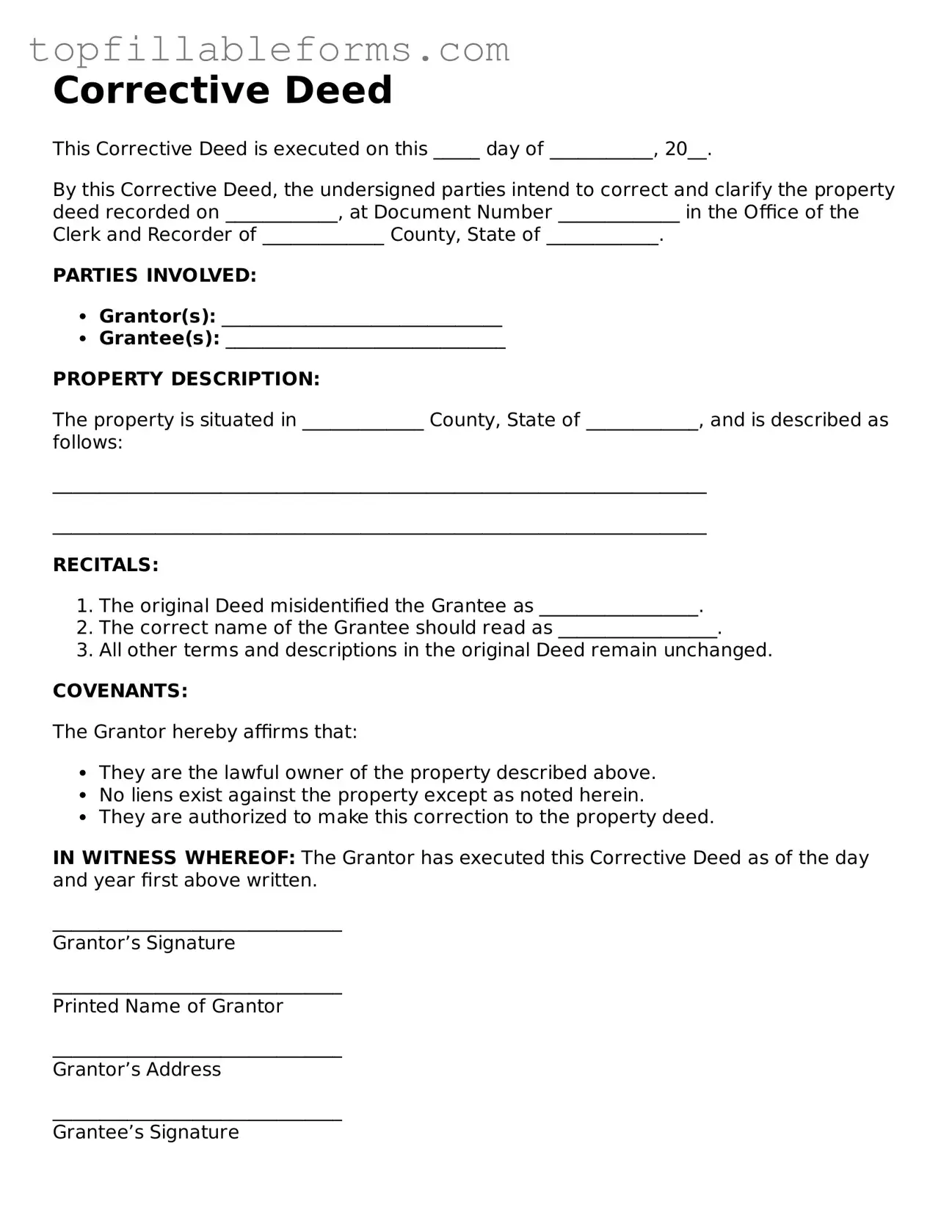

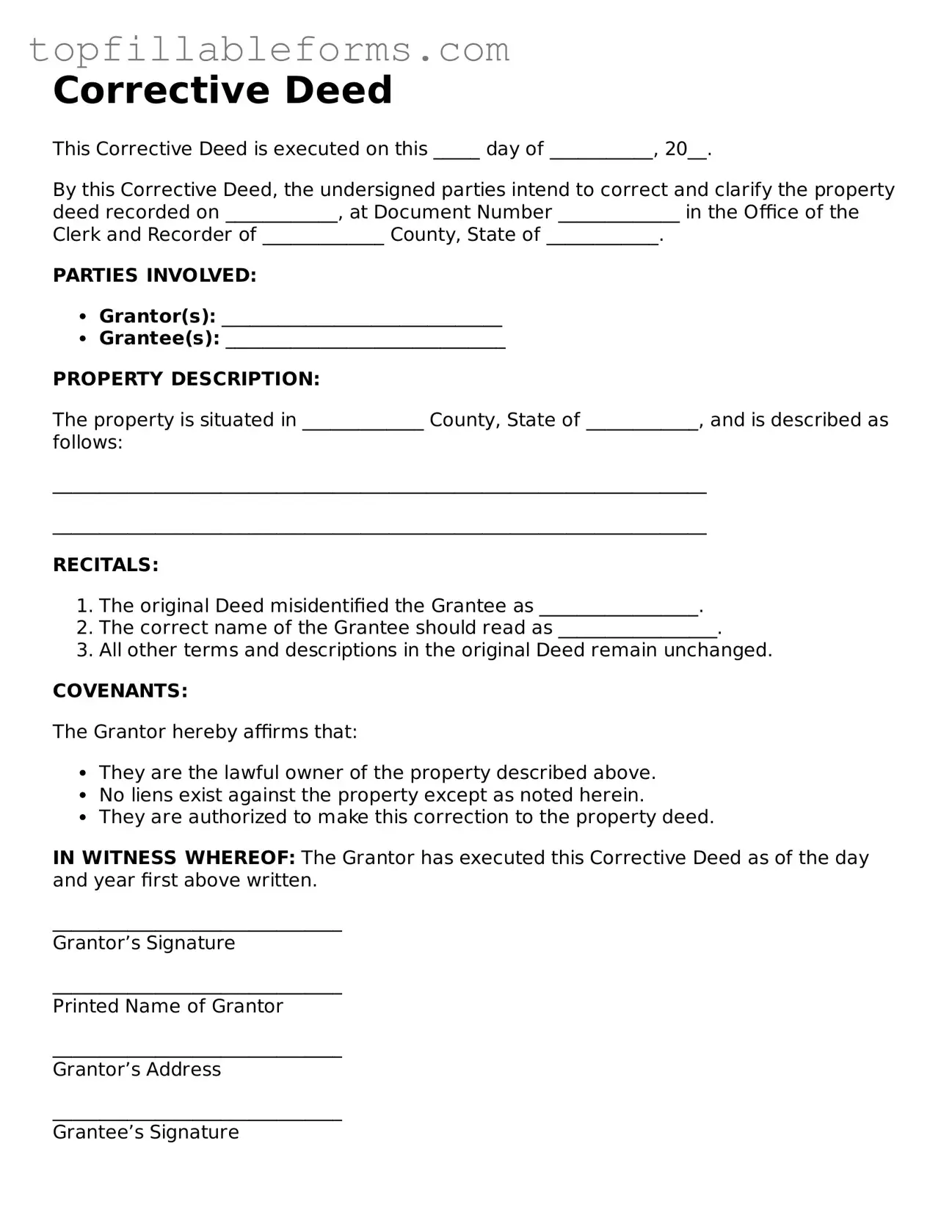

Free Corrective Deed Form

A Corrective Deed is a legal document used to fix errors in a property deed. It ensures that the information recorded accurately reflects the intentions of the parties involved. By addressing mistakes, this form helps prevent future disputes over property ownership.

Open Corrective Deed Editor Here

Free Corrective Deed Form

Open Corrective Deed Editor Here

Finish the form now and be done

Finish your Corrective Deed online by editing, saving, and downloading fast.

Open Corrective Deed Editor Here

or

▼ PDF File