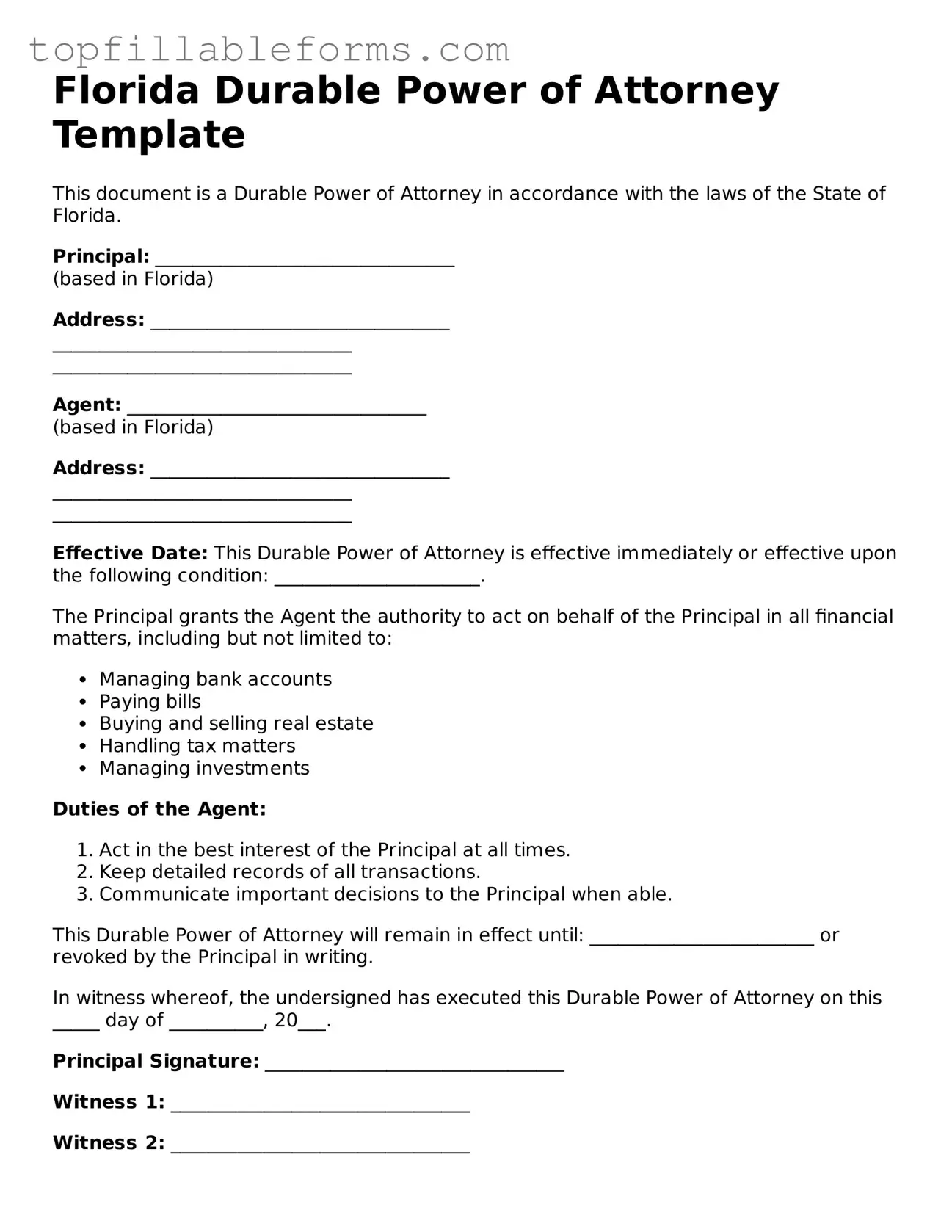

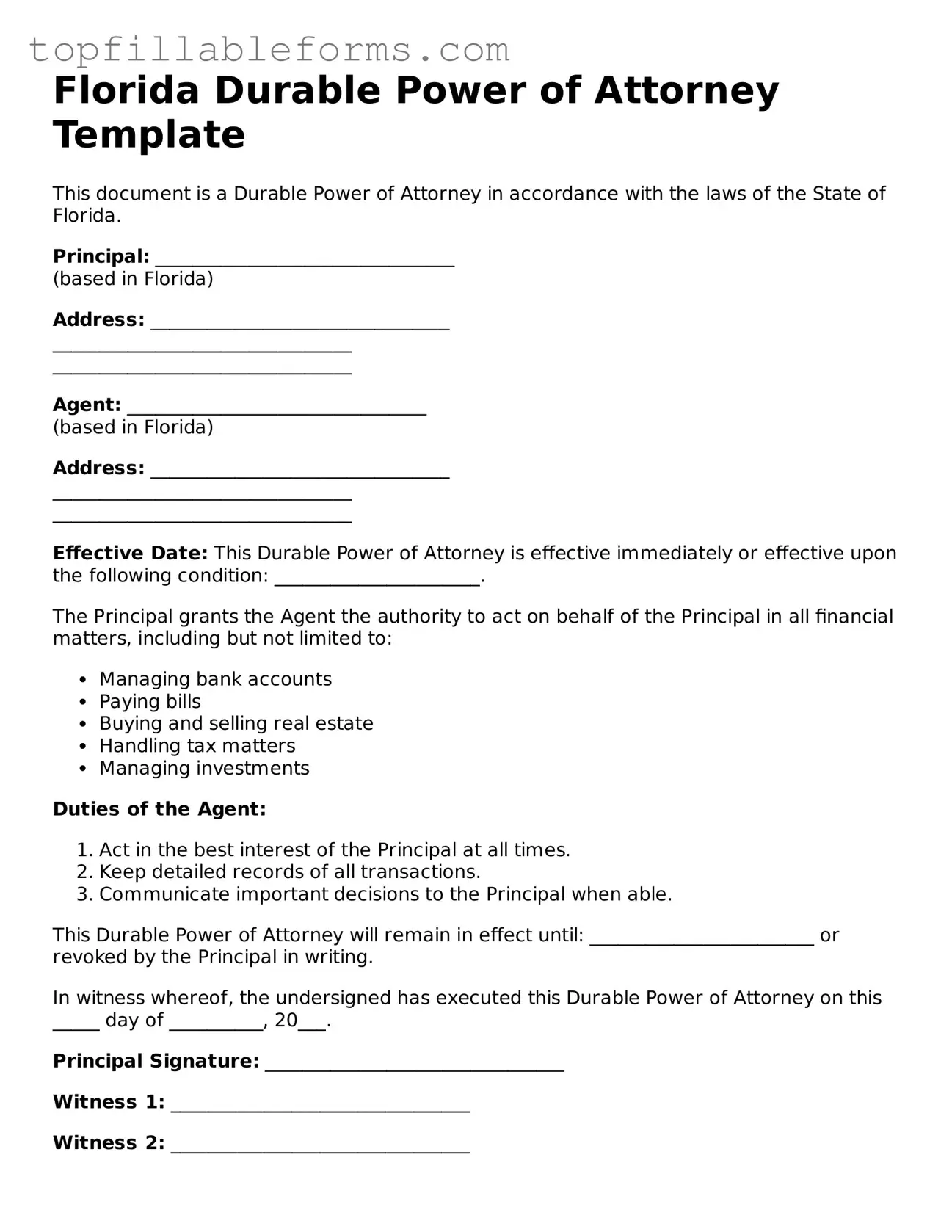

Attorney-Verified Durable Power of Attorney Template for Florida

A Florida Durable Power of Attorney form is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This trusted individual, known as your agent, can handle financial matters, manage property, and make important health care decisions. Understanding this form is crucial for ensuring your wishes are respected and your affairs are managed according to your preferences.

Open Durable Power of Attorney Editor Here

Attorney-Verified Durable Power of Attorney Template for Florida

Open Durable Power of Attorney Editor Here

Finish the form now and be done

Finish your Durable Power of Attorney online by editing, saving, and downloading fast.

Open Durable Power of Attorney Editor Here

or

▼ PDF File