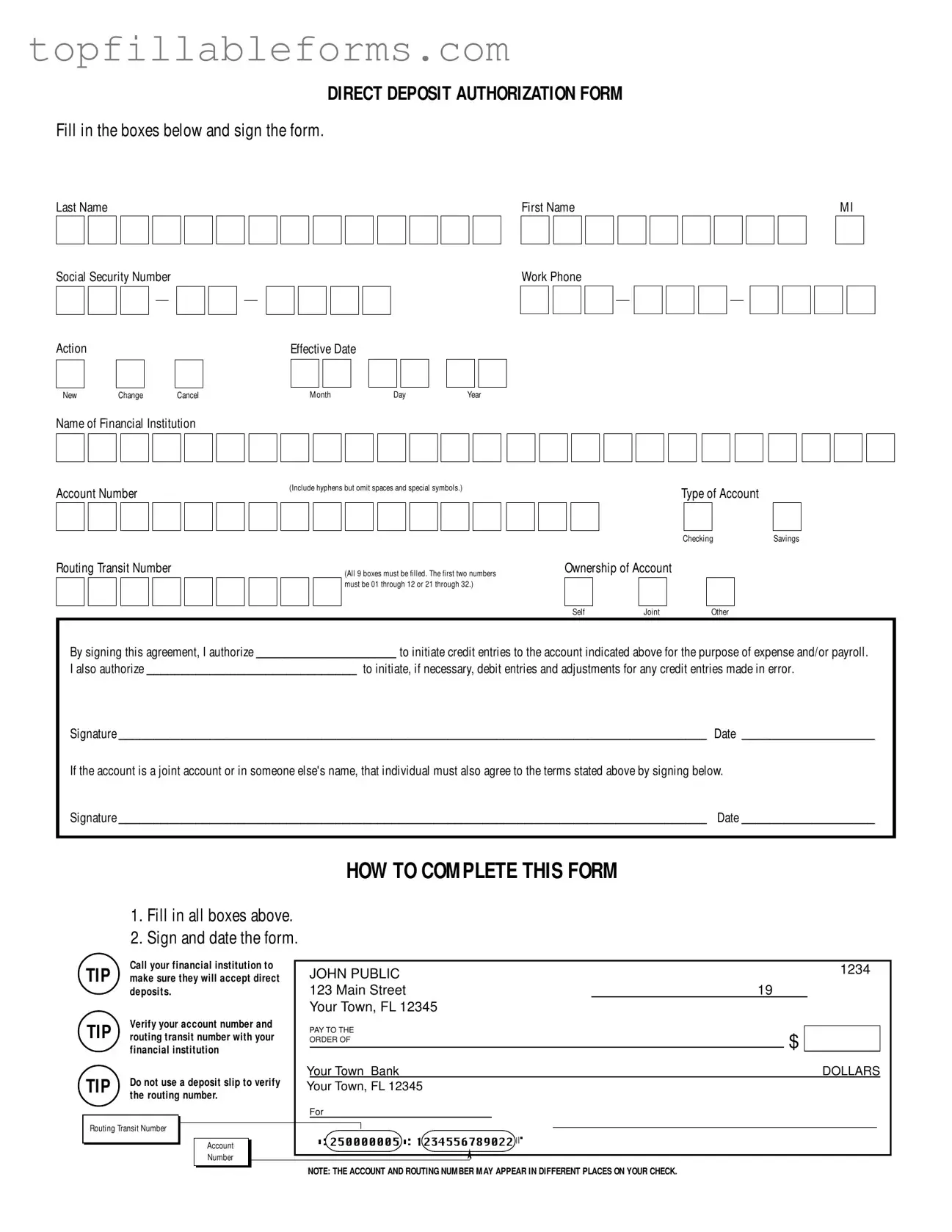

Printable Generic Direct Deposit Form in PDF

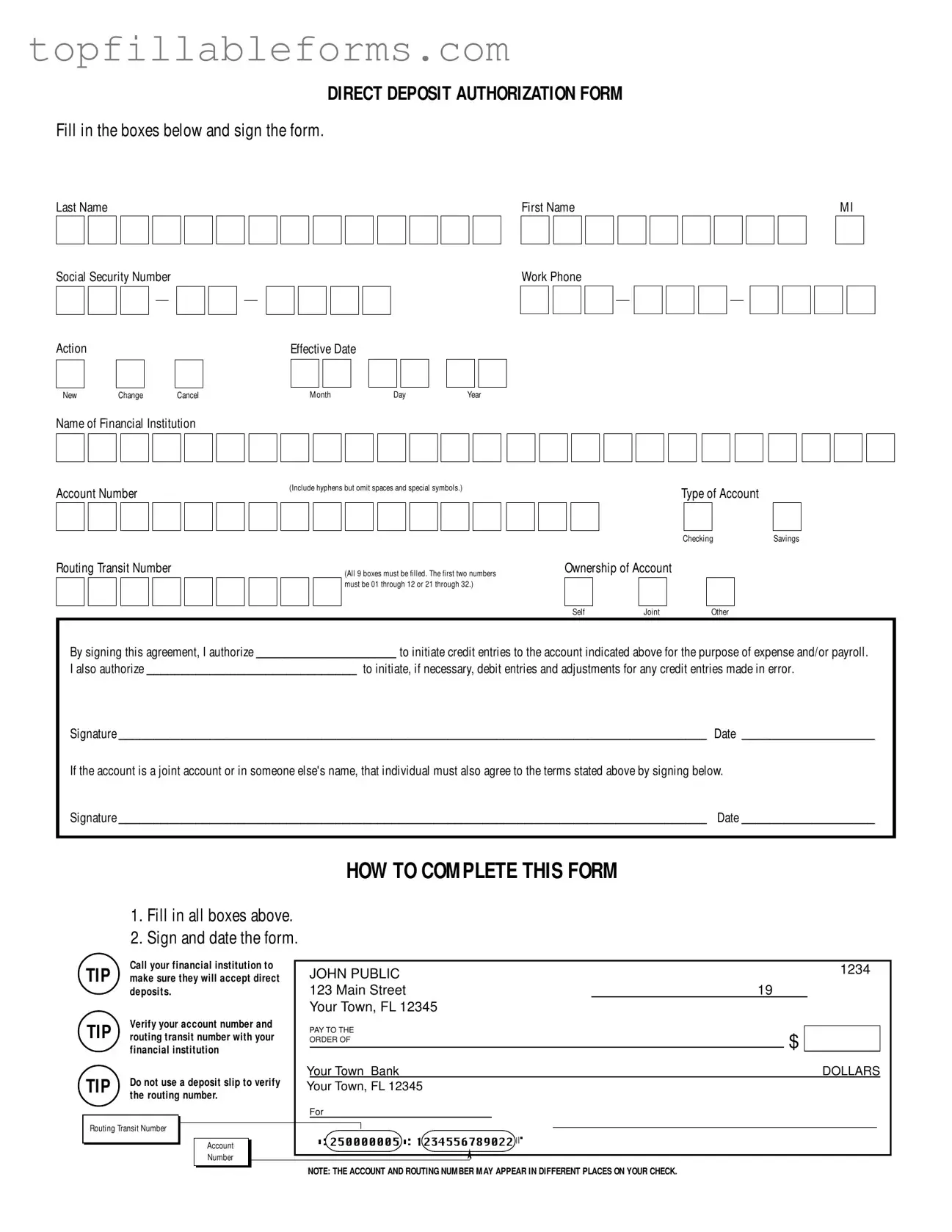

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. This form typically requires personal information, such as the individual's name, Social Security number, and bank account details. Completing this form ensures a streamlined process for receiving payments, whether for payroll or other expenses.

Open Generic Direct Deposit Editor Here

Printable Generic Direct Deposit Form in PDF

Open Generic Direct Deposit Editor Here

Finish the form now and be done

Finish your Generic Direct Deposit online by editing, saving, and downloading fast.

Open Generic Direct Deposit Editor Here

or

▼ PDF File

□

□