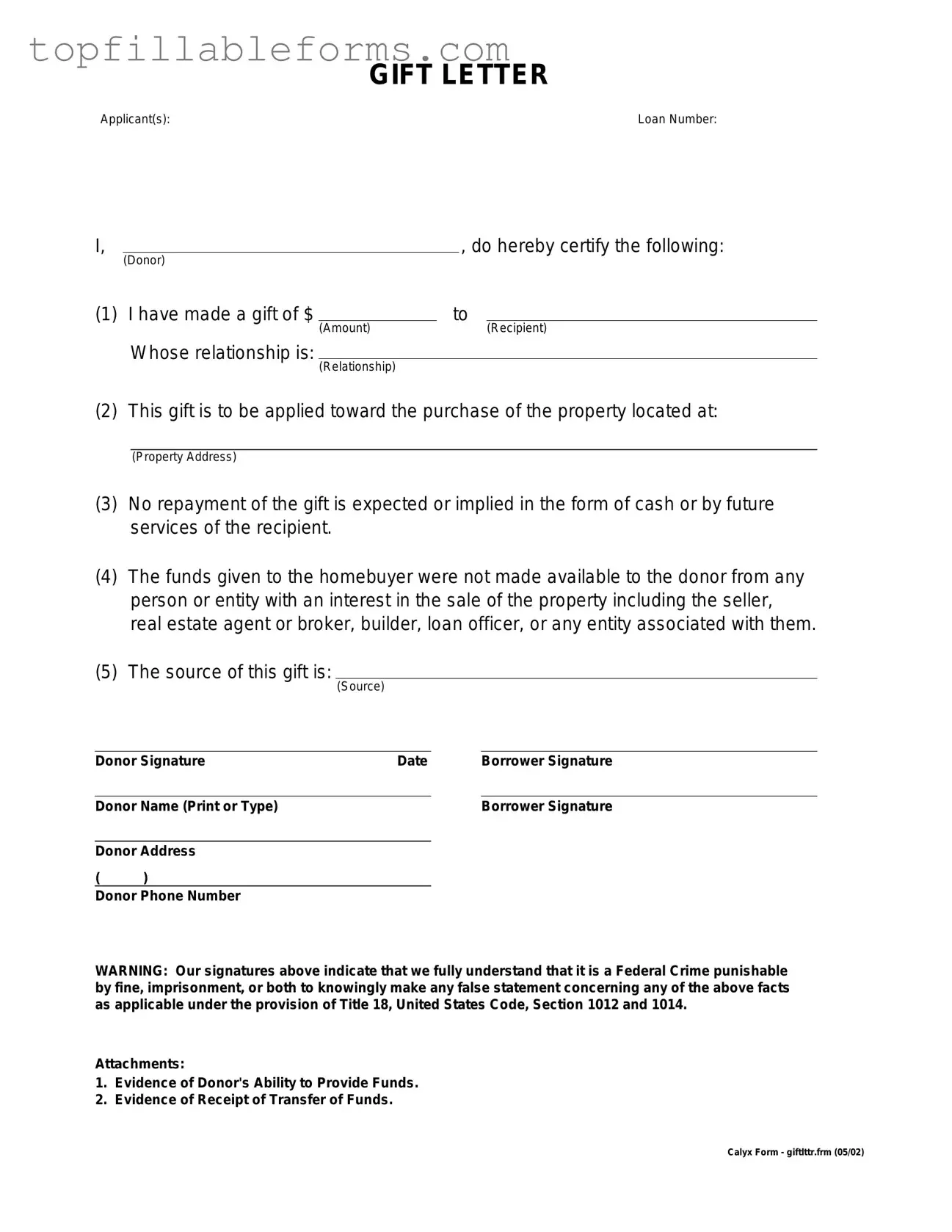

Printable Gift Letter Form in PDF

The Gift Letter form is a document used to confirm that a financial gift has been given without the expectation of repayment. This form is often required in real estate transactions, particularly for mortgage applications, to verify that the funds are indeed a gift and not a loan. By providing clarity and transparency, the Gift Letter helps ensure that both parties understand the nature of the transaction.

Open Gift Letter Editor Here

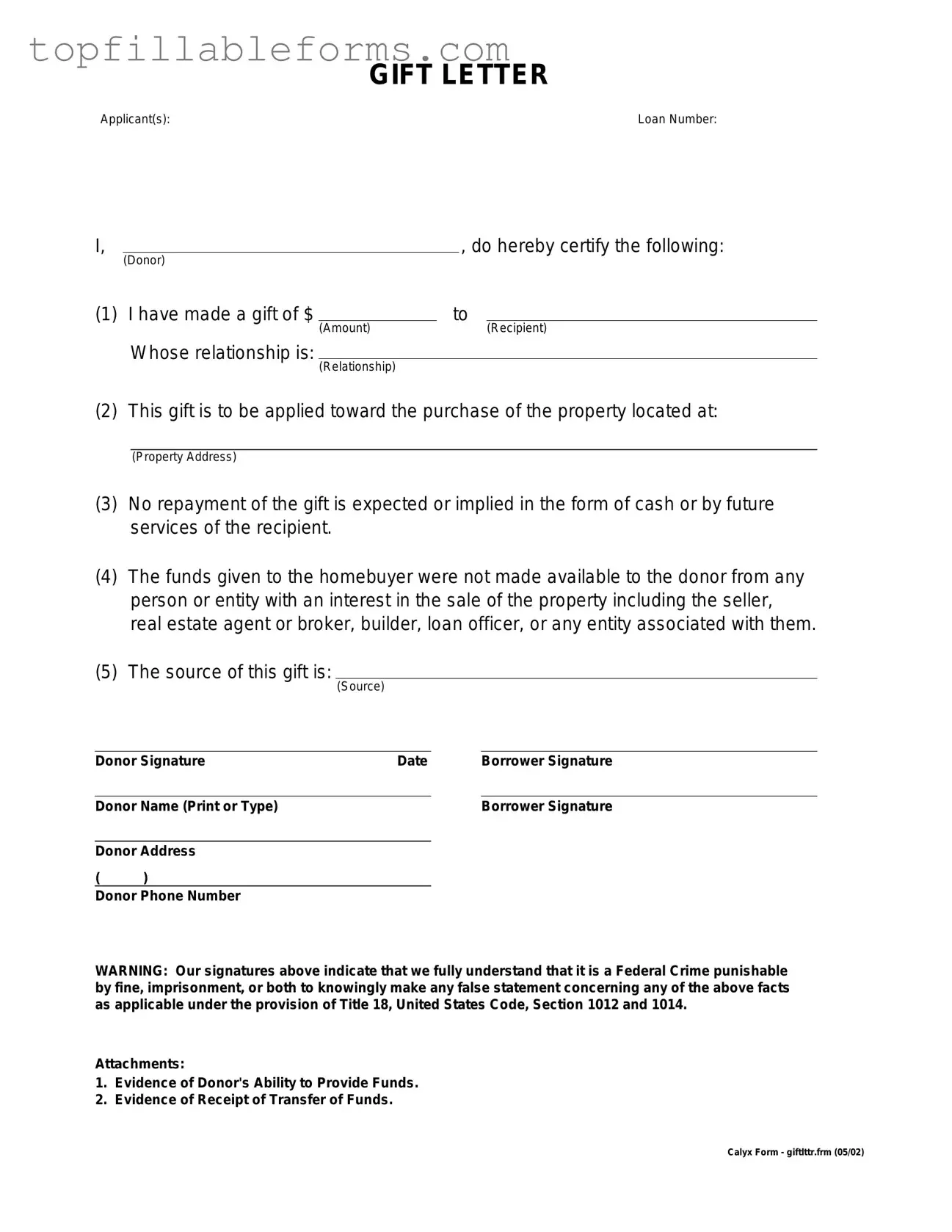

Printable Gift Letter Form in PDF

Open Gift Letter Editor Here

Finish the form now and be done

Finish your Gift Letter online by editing, saving, and downloading fast.

Open Gift Letter Editor Here

or

▼ PDF File