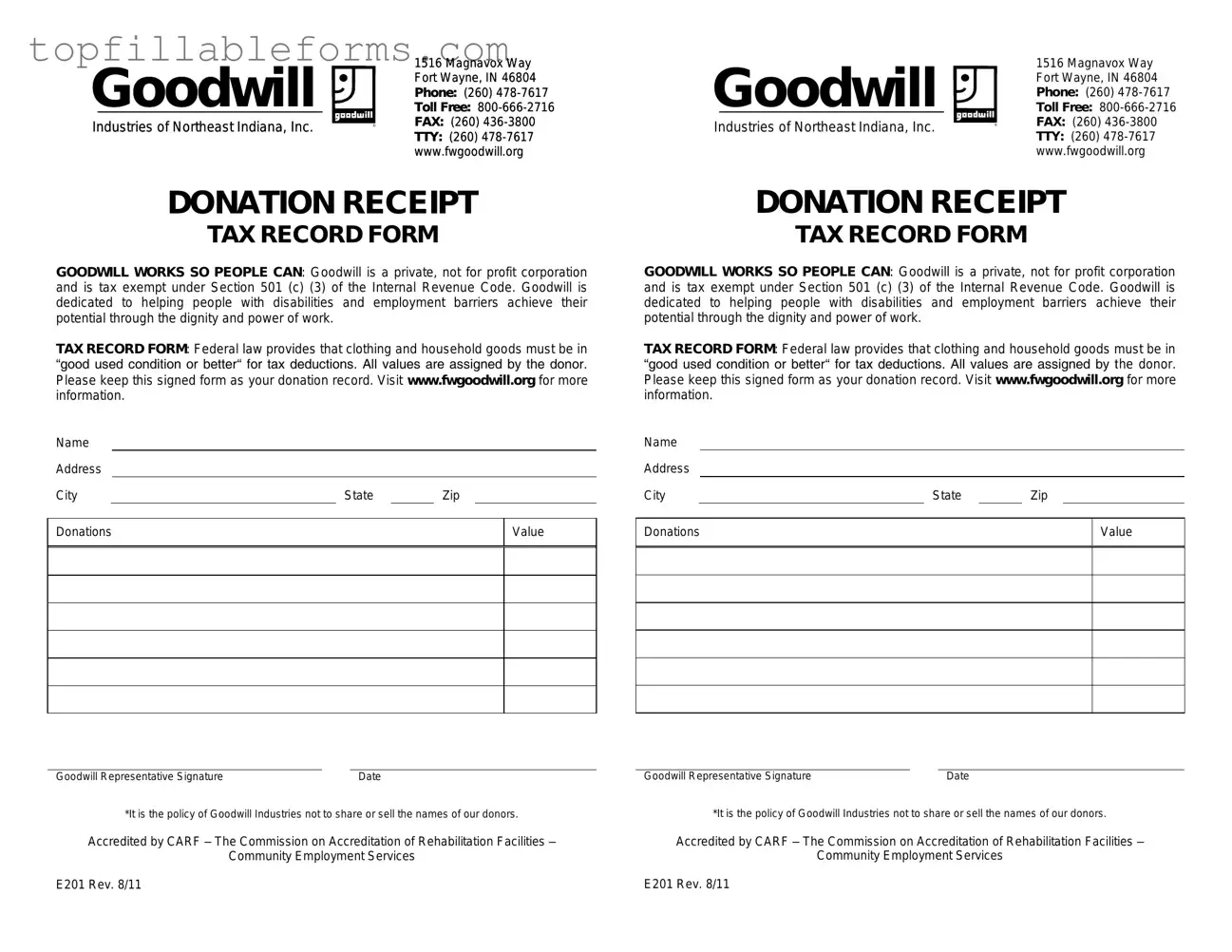

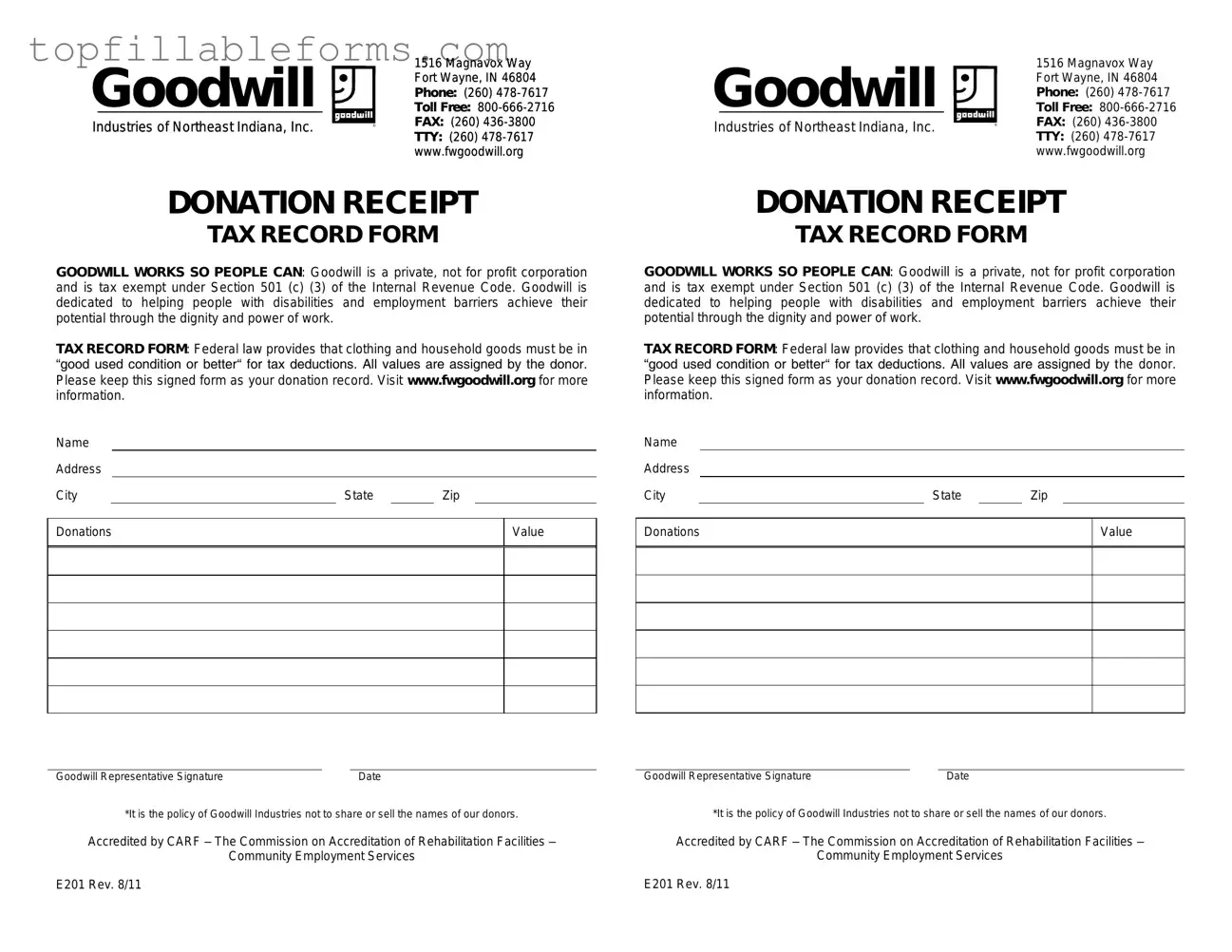

Printable Goodwill donation receipt Form in PDF

The Goodwill donation receipt form is an important document provided to donors when they contribute items to Goodwill Industries. This form serves as proof of the donation and can be used for tax purposes. Understanding how to properly fill out and utilize this receipt can help ensure that you receive the full benefits of your charitable contributions.

Open Goodwill donation receipt Editor Here

Printable Goodwill donation receipt Form in PDF

Open Goodwill donation receipt Editor Here

Finish the form now and be done

Finish your Goodwill donation receipt online by editing, saving, and downloading fast.

Open Goodwill donation receipt Editor Here

or

▼ PDF File