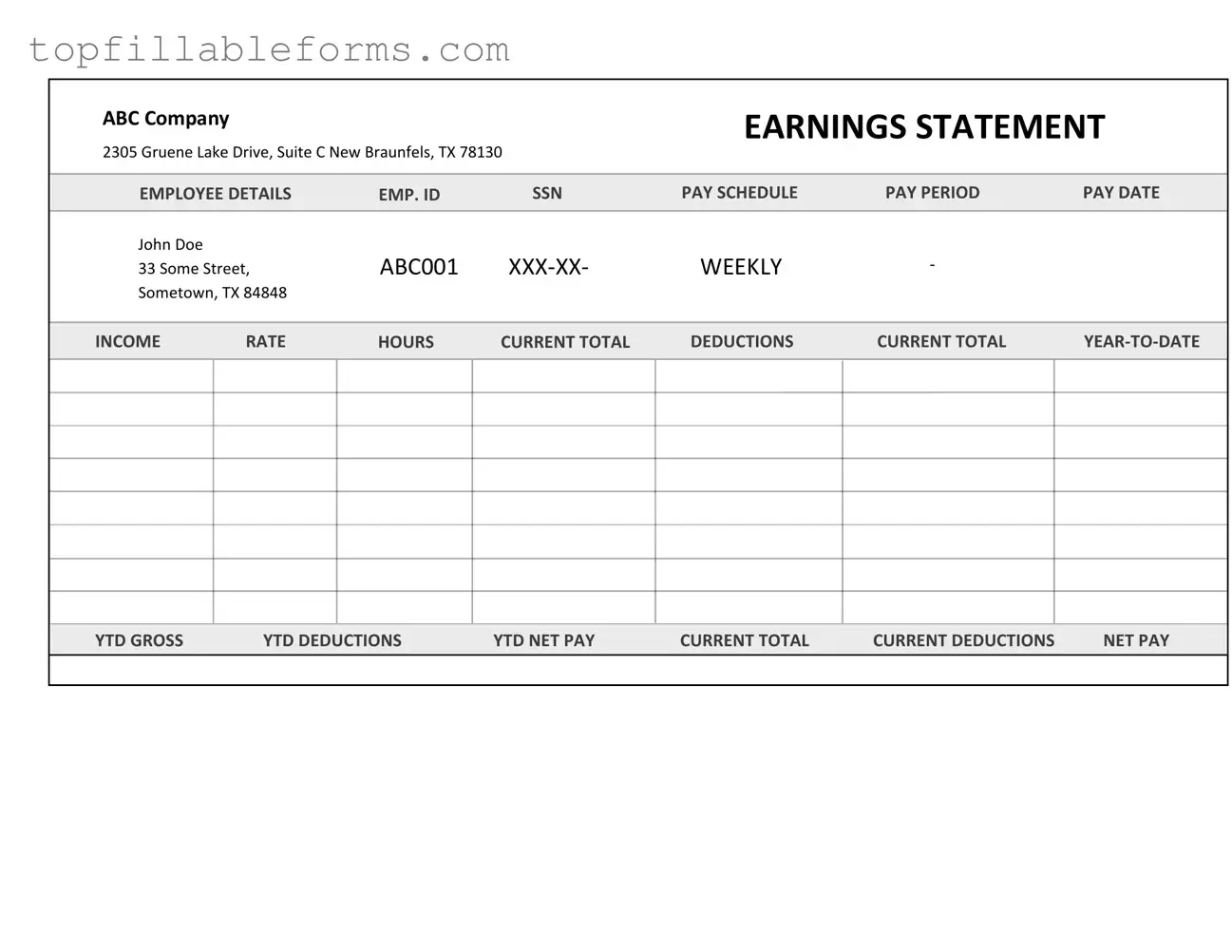

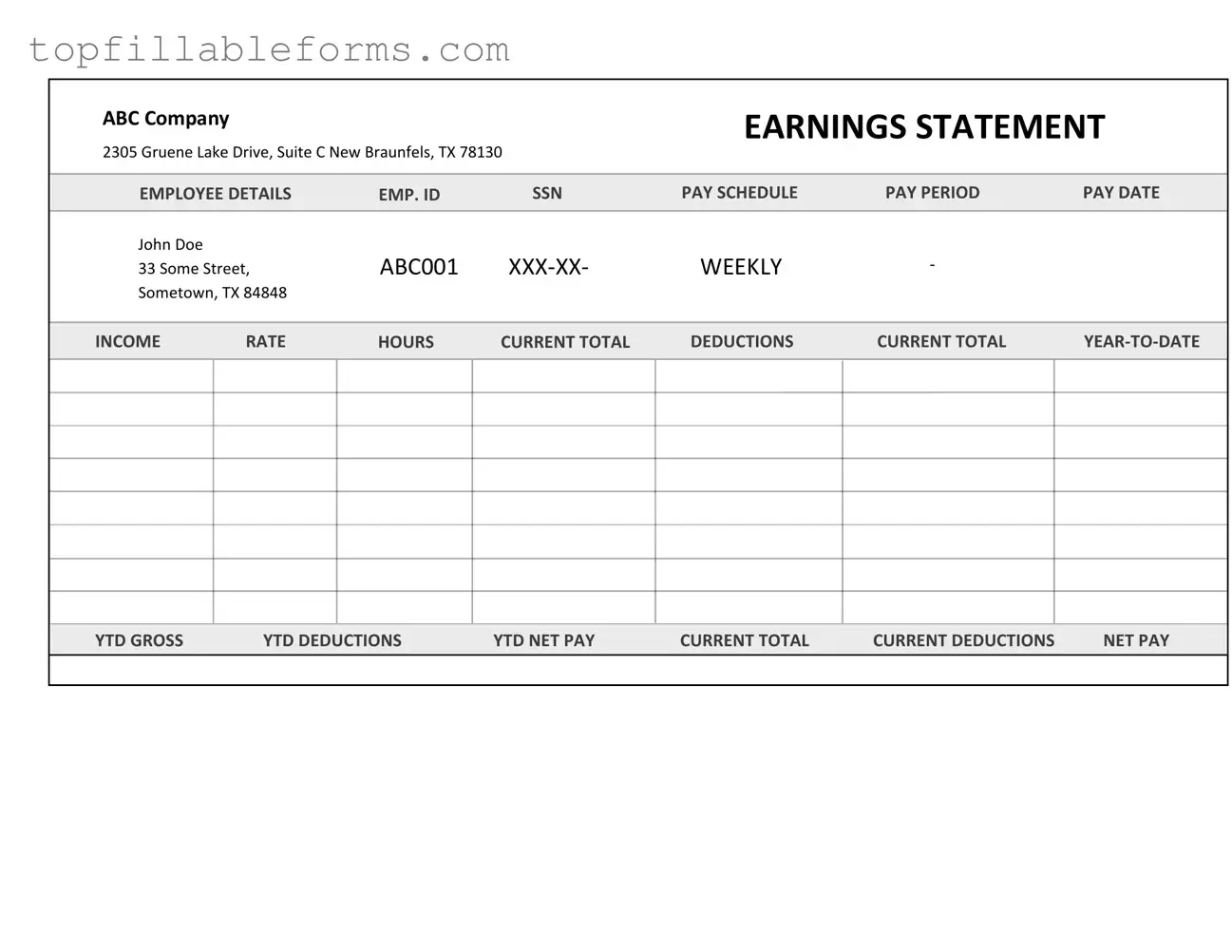

Printable Independent Contractor Pay Stub Form in PDF

The Independent Contractor Pay Stub form serves as a crucial document that outlines the earnings and deductions for individuals who work as independent contractors. This form provides transparency, ensuring that contractors can easily track their income and understand the financial aspects of their work. Understanding this document is essential for both contractors and businesses to maintain clear financial records and comply with tax obligations.

Open Independent Contractor Pay Stub Editor Here

Printable Independent Contractor Pay Stub Form in PDF

Open Independent Contractor Pay Stub Editor Here

Finish the form now and be done

Finish your Independent Contractor Pay Stub online by editing, saving, and downloading fast.

Open Independent Contractor Pay Stub Editor Here

or

▼ PDF File