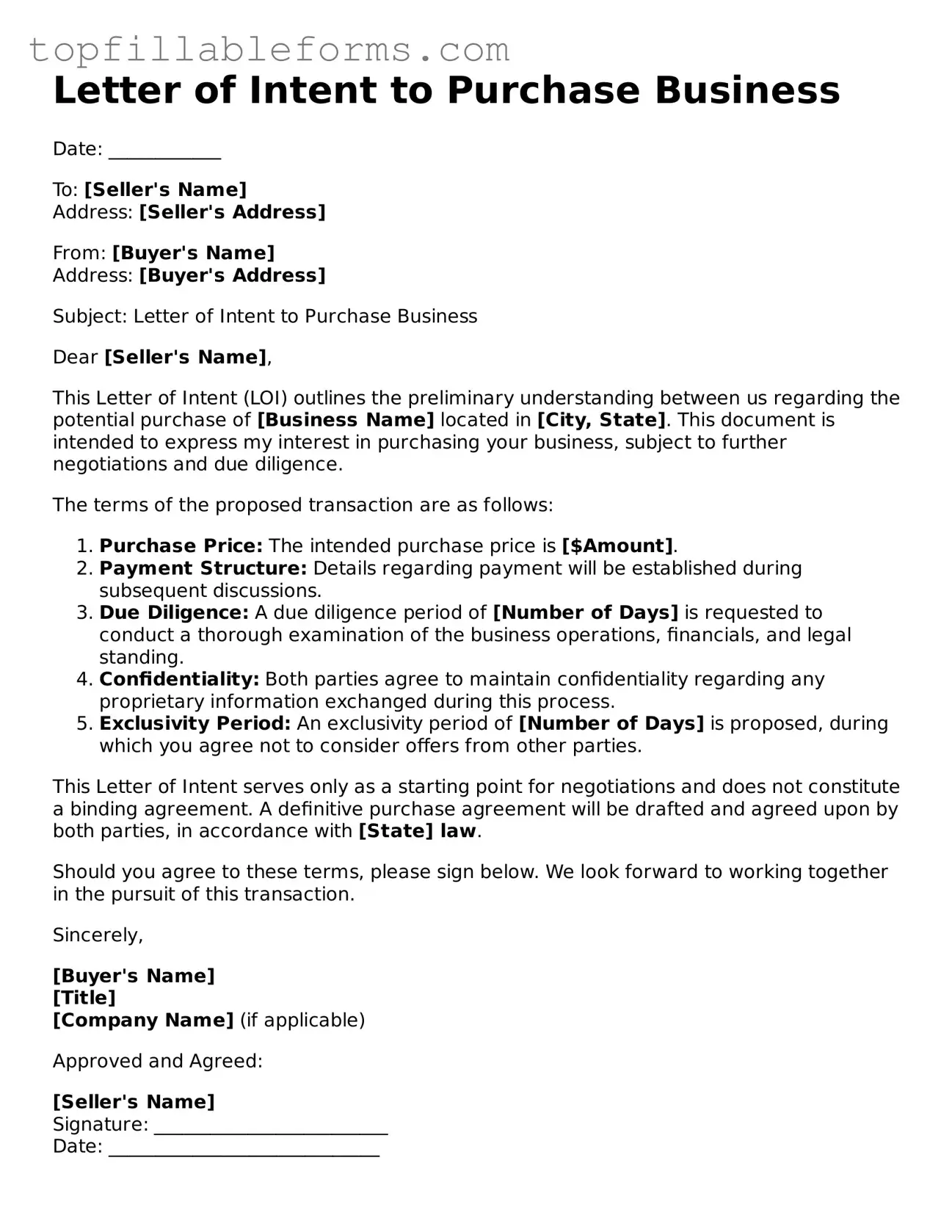

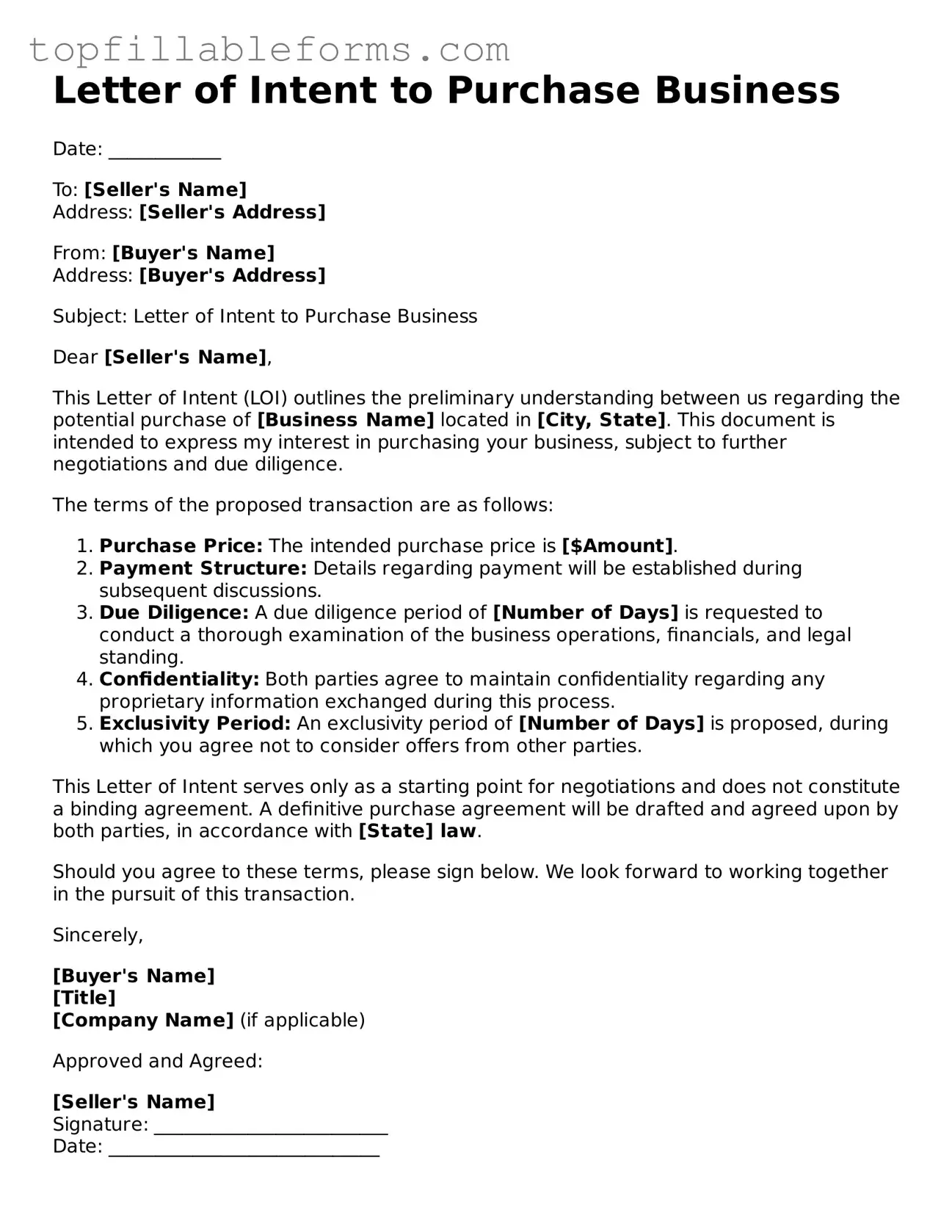

Free Letter of Intent to Purchase Business Form

A Letter of Intent to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. This form serves as a roadmap for negotiations, detailing key terms and conditions before a formal purchase agreement is drafted. By clarifying intentions, it helps both parties navigate the complexities of a business transaction.

Open Letter of Intent to Purchase Business Editor Here

Free Letter of Intent to Purchase Business Form

Open Letter of Intent to Purchase Business Editor Here

Finish the form now and be done

Finish your Letter of Intent to Purchase Business online by editing, saving, and downloading fast.

Open Letter of Intent to Purchase Business Editor Here

or

▼ PDF File