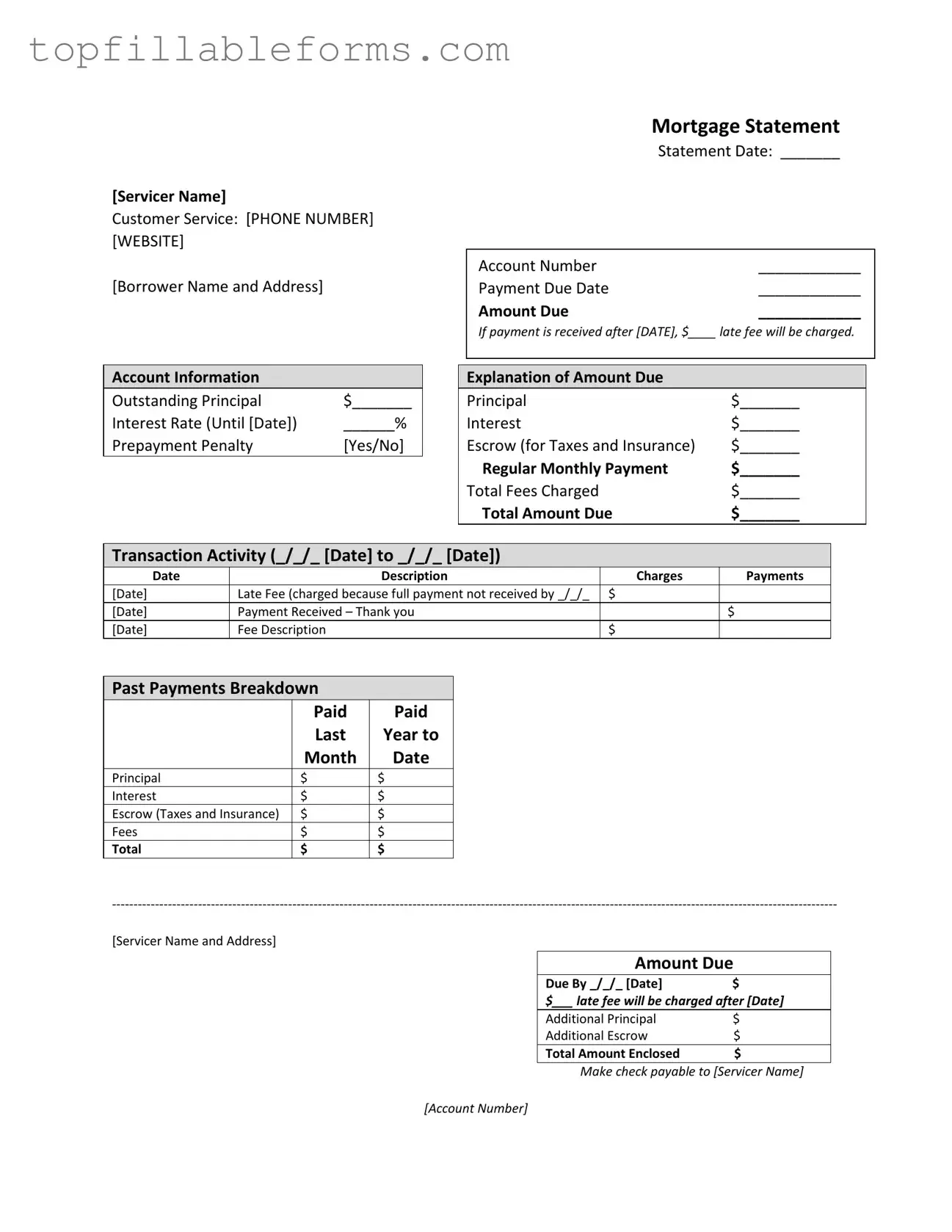

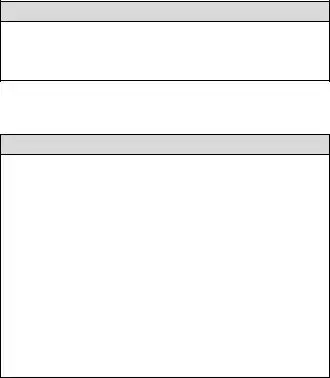

Printable Mortgage Statement Form in PDF

The Mortgage Statement form is a crucial document that outlines the details of your mortgage account, including payment history and outstanding balances. This statement serves as a summary of what you owe and any fees that may apply, ensuring you stay informed about your financial obligations. Understanding this form can help you manage your mortgage effectively and avoid potential pitfalls.

Open Mortgage Statement Editor Here

Printable Mortgage Statement Form in PDF

Open Mortgage Statement Editor Here

Finish the form now and be done

Finish your Mortgage Statement online by editing, saving, and downloading fast.

Open Mortgage Statement Editor Here

or

▼ PDF File