- Misconception 1: The P45 form is only necessary for employees who leave their job voluntarily.

This is not true. The P45 form is required for all employees who leave a job, regardless of the reason for their departure, including layoffs or terminations.

- Misconception 2: Employees do not need to keep their P45 once they start a new job.

In fact, it is essential for employees to keep their P45. This document contains important tax information that may be required for future tax returns or when starting a new job.

- Misconception 3: Employers do not need to send the P45 to HMRC if the employee has left the company.

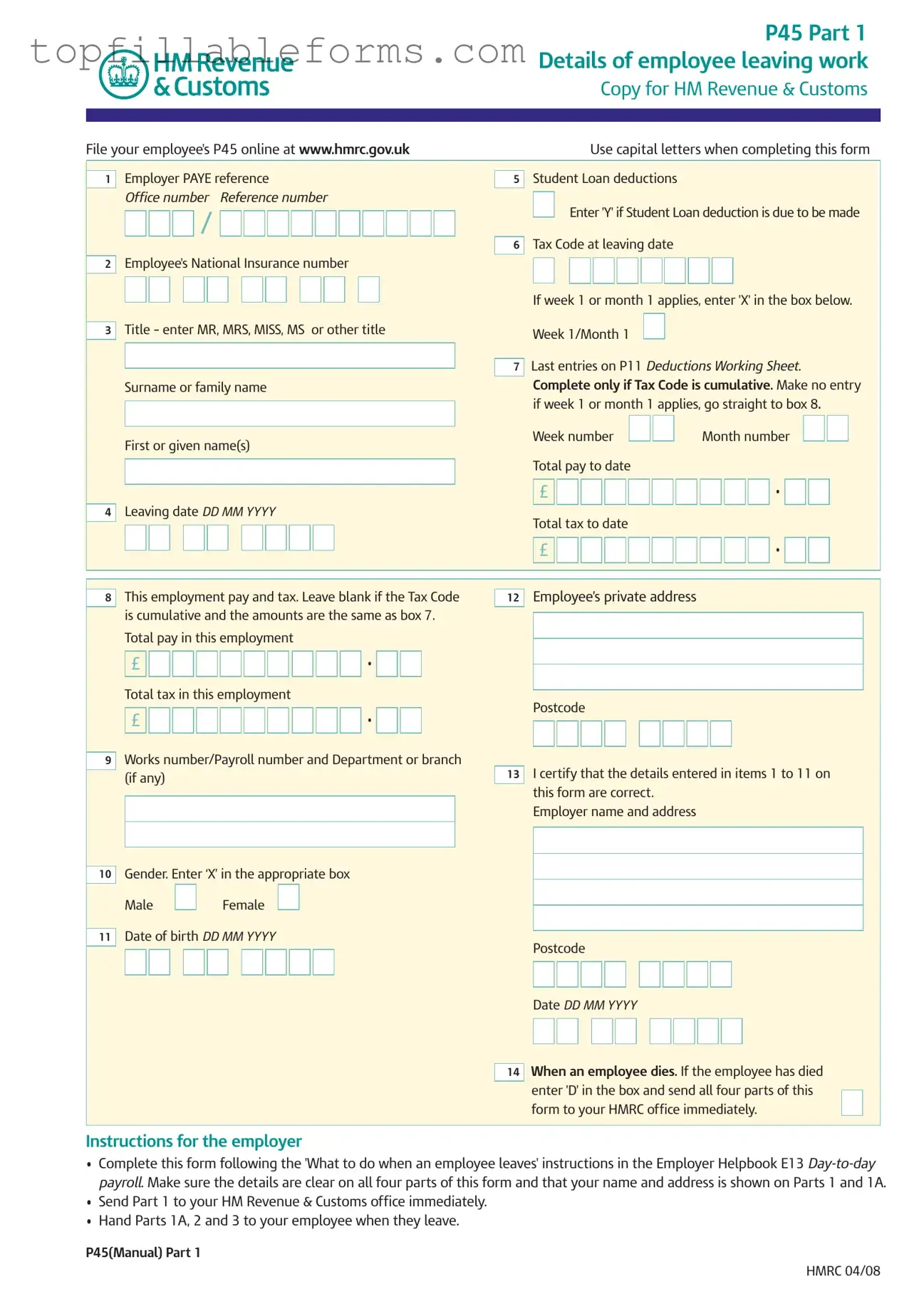

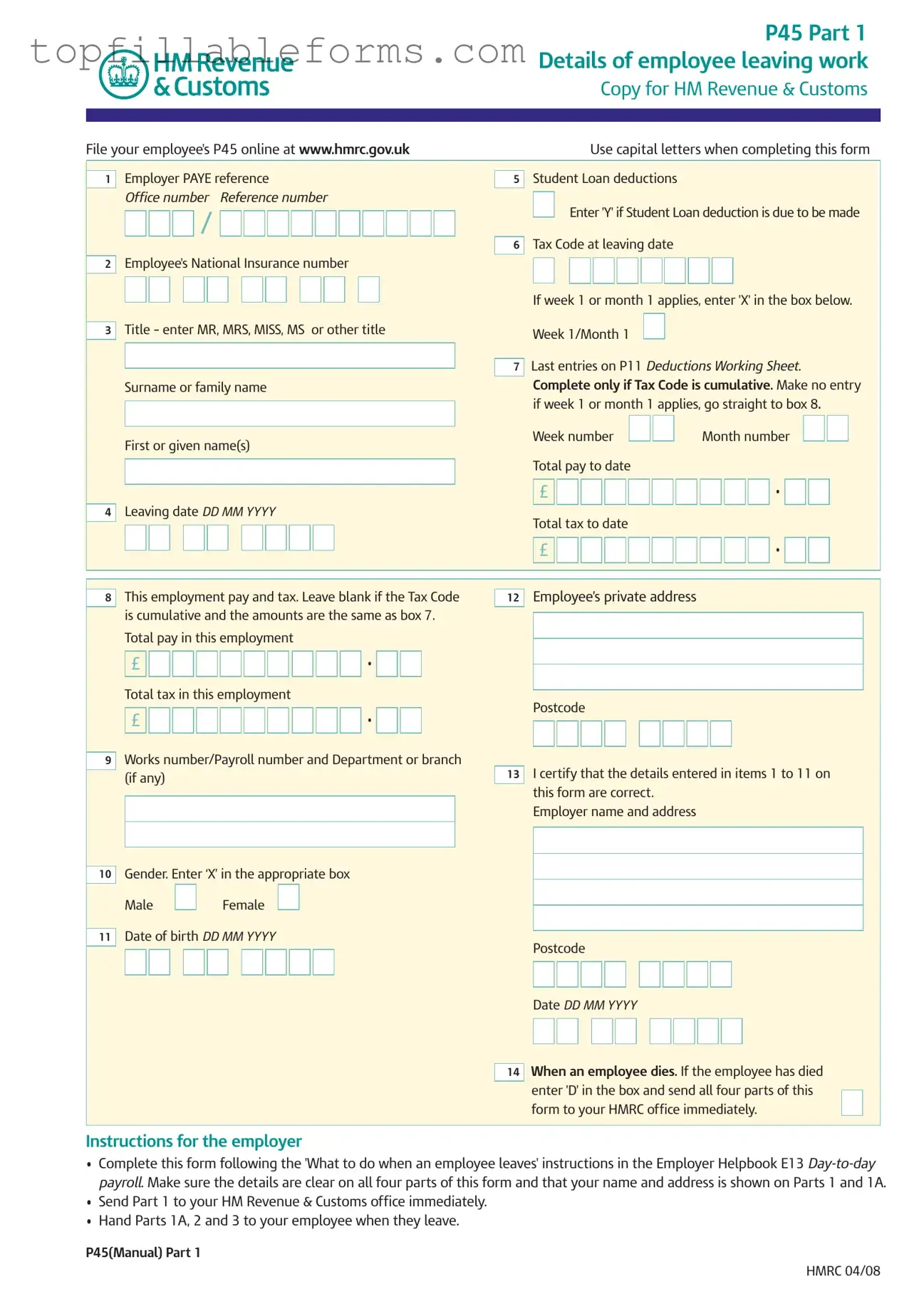

Employers must send Part 1 of the P45 to HM Revenue & Customs (HMRC) immediately after an employee leaves. This ensures that the employee's tax records are updated correctly.

- Misconception 4: The P45 form is the same as a final payslip.

The P45 is not a payslip. It summarizes the employee's total pay and tax deductions for the tax year up to the point of leaving, while a payslip details earnings and deductions for a specific pay period.

- Misconception 5: The P45 form is only relevant for tax purposes.

While the P45 is crucial for tax purposes, it is also important for other benefits, such as claiming Jobseeker's Allowance or Employment and Support Allowance.

- Misconception 6: An employee can receive multiple P45 forms from different employers at the same time.

Employees should only receive one P45 from each employer when they leave that job. If they have multiple jobs, they will receive a separate P45 for each job upon leaving.

- Misconception 7: Employees can disregard the P45 if they plan to work abroad.

This is incorrect. Employees should still keep their P45, as it may be needed for tax purposes when they return to the UK or if they need to claim a tax refund.

- Misconception 8: The P45 form does not require any personal information.

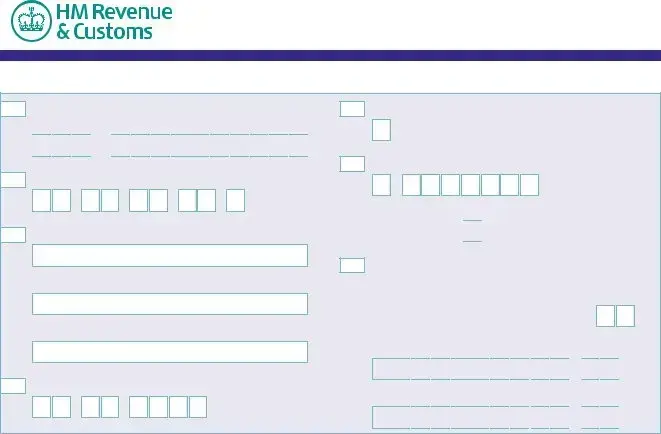

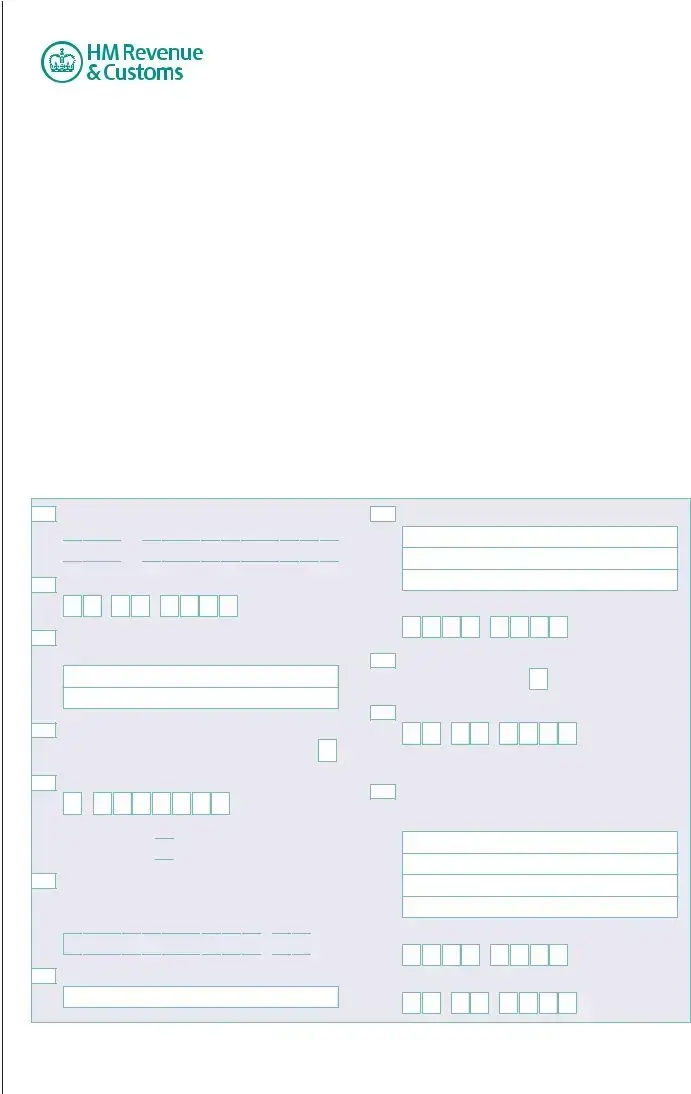

On the contrary, the P45 requires various personal details, including the employee's National Insurance number, leaving date, and total pay and tax to date.

- Misconception 9: The P45 form can be altered after it has been issued.

Once issued, the P45 should not be altered in any way. Doing so can lead to complications with tax records and potential penalties.

- Misconception 10: Only employees in the UK need a P45.

While the P45 is specific to the UK tax system, it is essential for all employees working in the UK, regardless of their nationality or residency status.

/

/

•

•

•

•

/

/

•

•