Printable Payroll Check Form in PDF

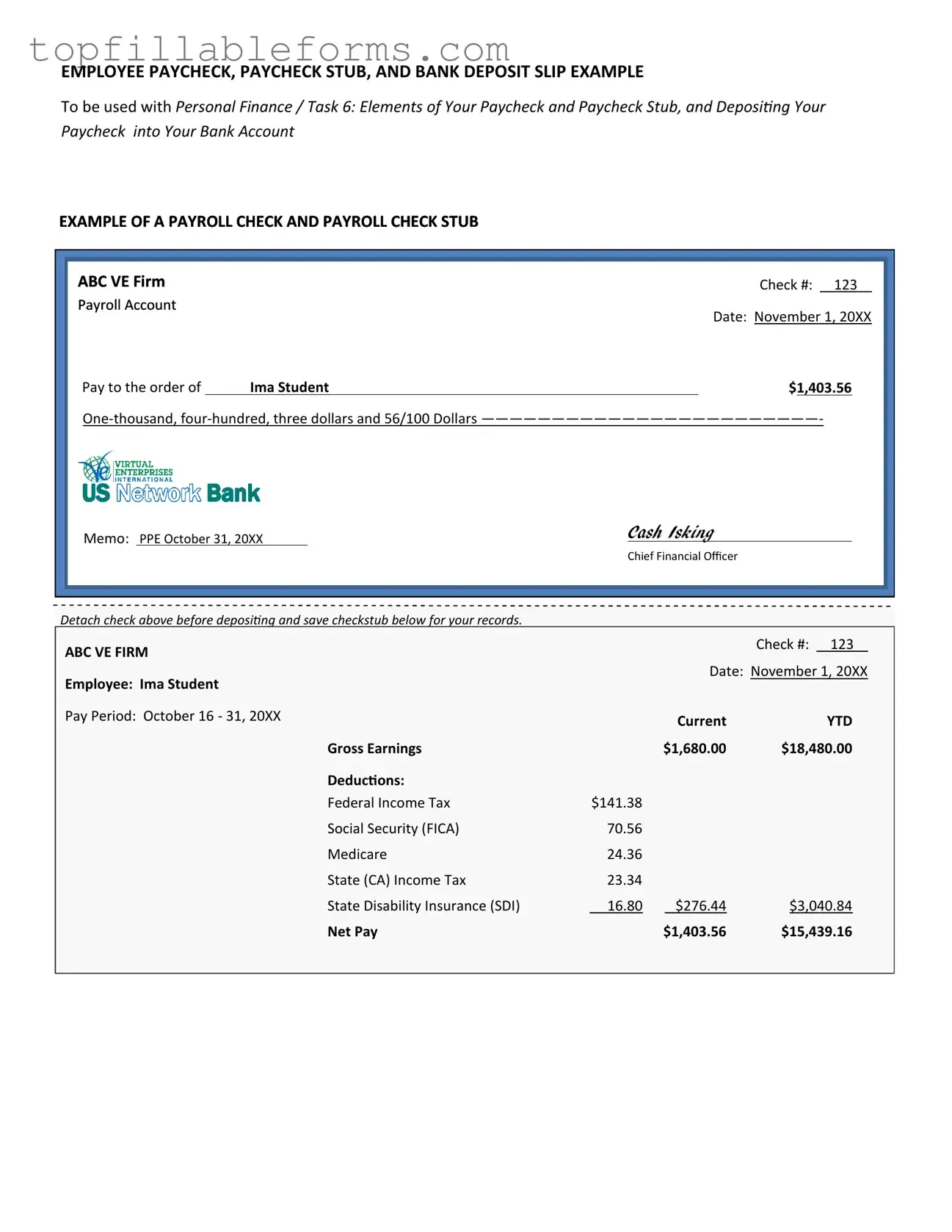

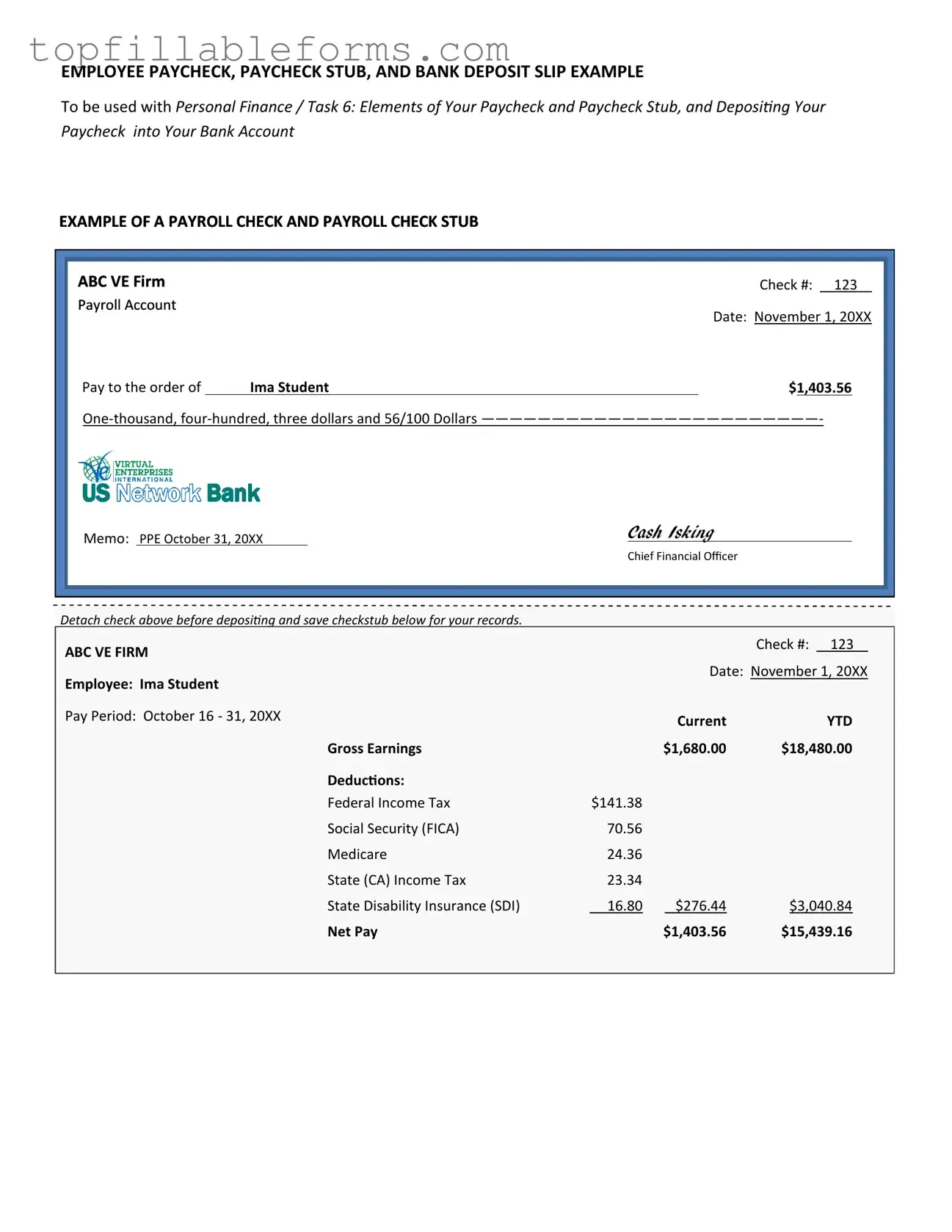

The Payroll Check form is a crucial document used by employers to disburse wages to their employees. This form outlines the amount earned, deductions taken, and the net pay that the employee will receive. Understanding its components and proper usage is essential for both employers and employees to ensure accurate and timely payments.

Open Payroll Check Editor Here

Printable Payroll Check Form in PDF

Open Payroll Check Editor Here

Finish the form now and be done

Finish your Payroll Check online by editing, saving, and downloading fast.

Open Payroll Check Editor Here

or

▼ PDF File