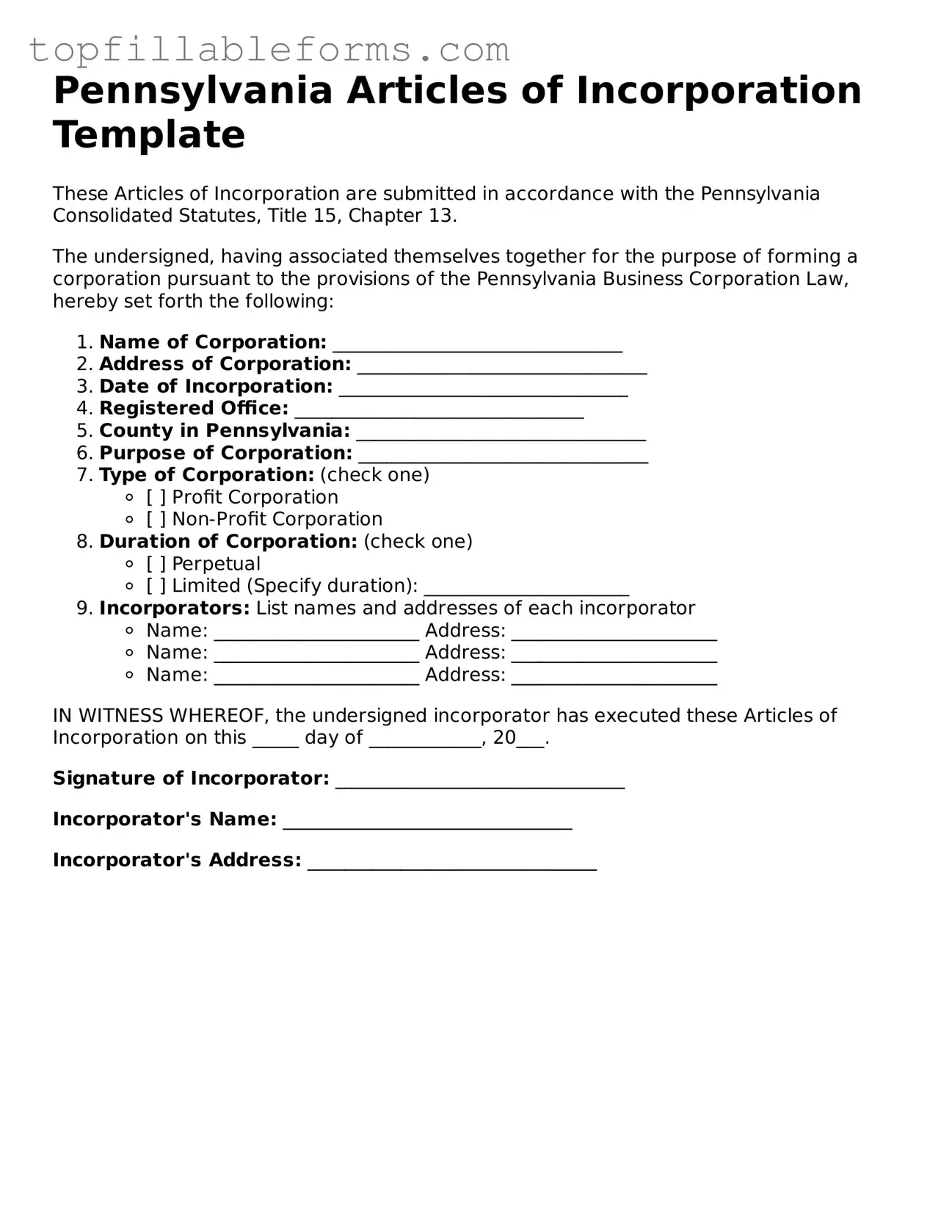

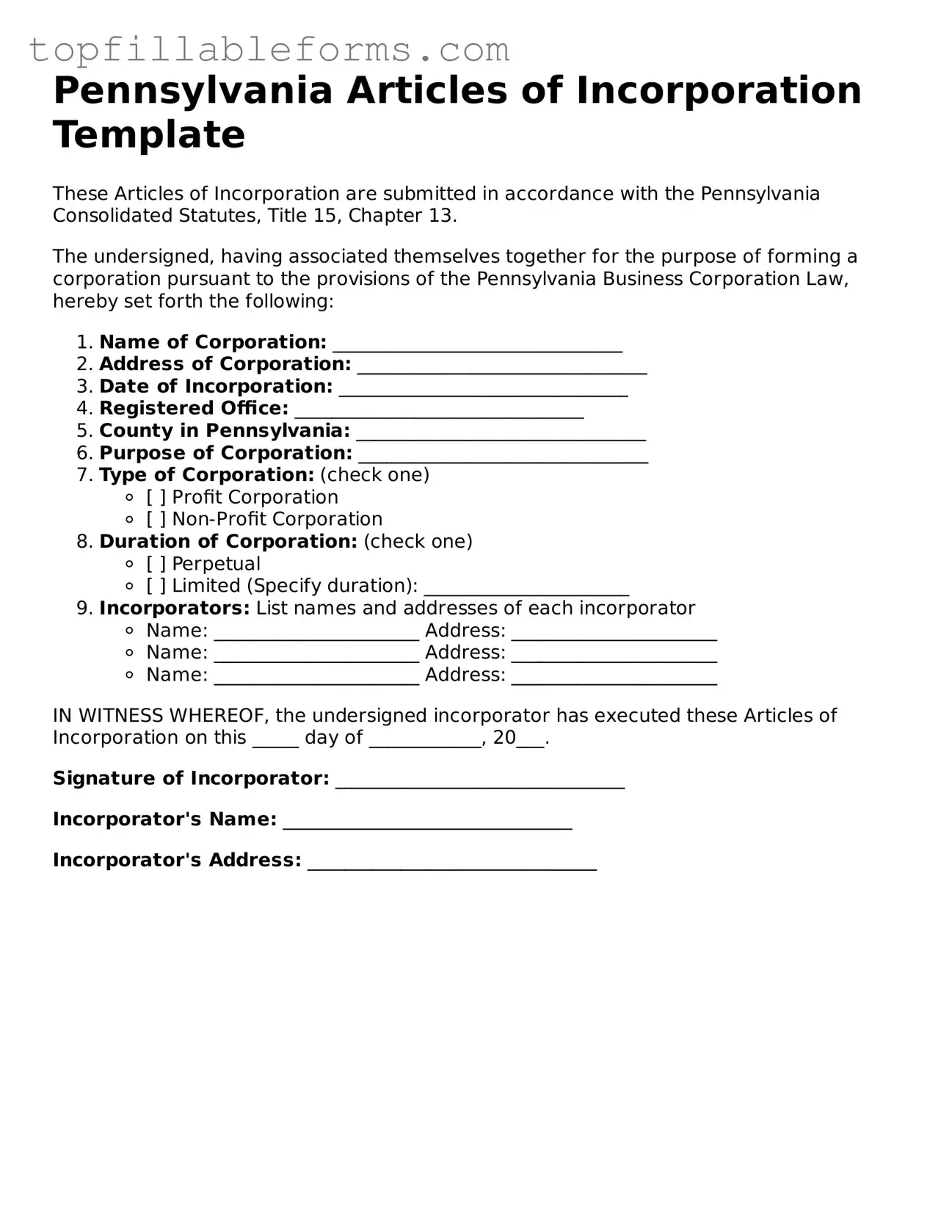

Attorney-Verified Articles of Incorporation Template for Pennsylvania

The Pennsylvania Articles of Incorporation form is a legal document that establishes a corporation in the state of Pennsylvania. This form outlines essential details such as the corporation's name, purpose, and structure, serving as a foundational step for anyone looking to create a business entity. Understanding how to properly complete this form is crucial for compliance with state regulations and for ensuring the long-term success of the corporation.

Open Articles of Incorporation Editor Here

Attorney-Verified Articles of Incorporation Template for Pennsylvania

Open Articles of Incorporation Editor Here

Finish the form now and be done

Finish your Articles of Incorporation online by editing, saving, and downloading fast.

Open Articles of Incorporation Editor Here

or

▼ PDF File