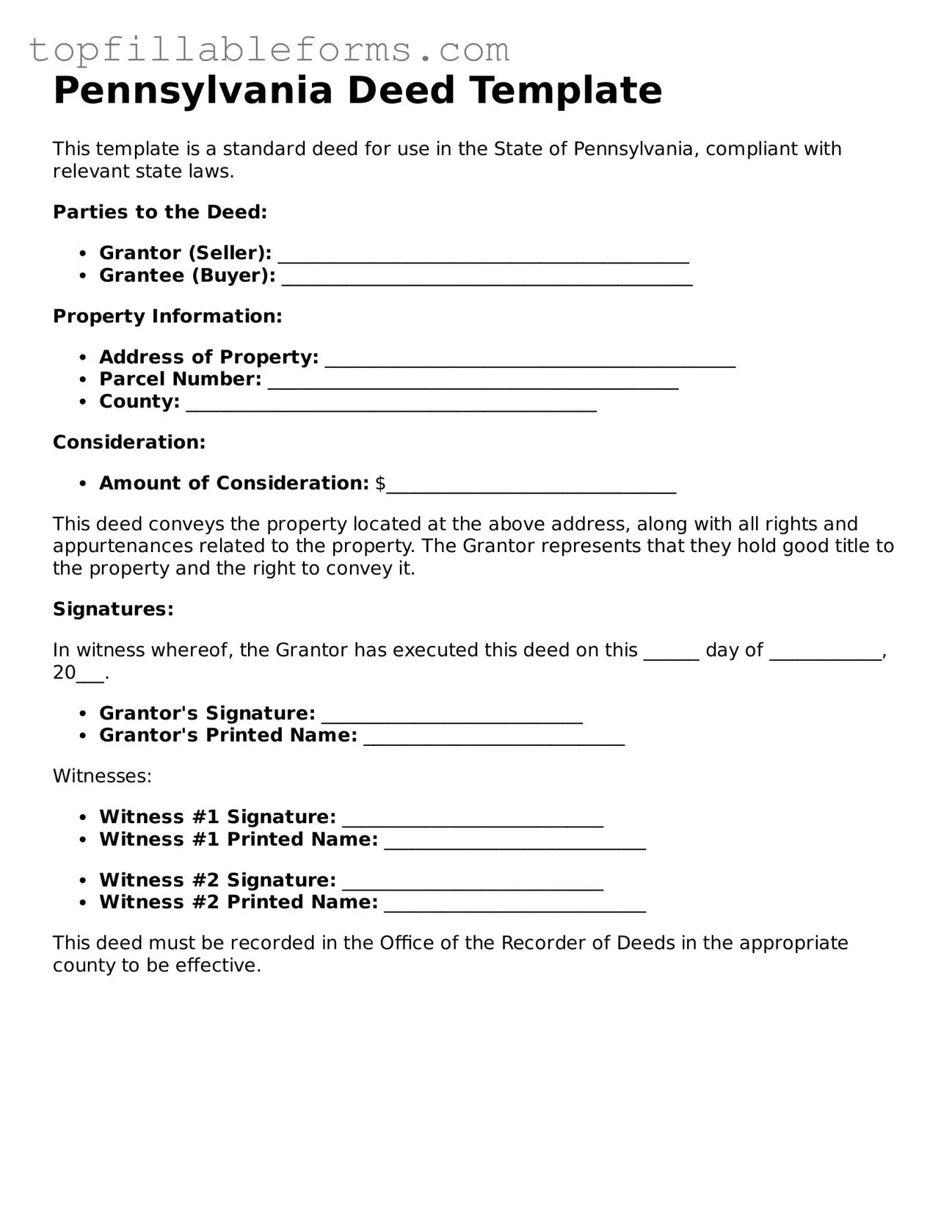

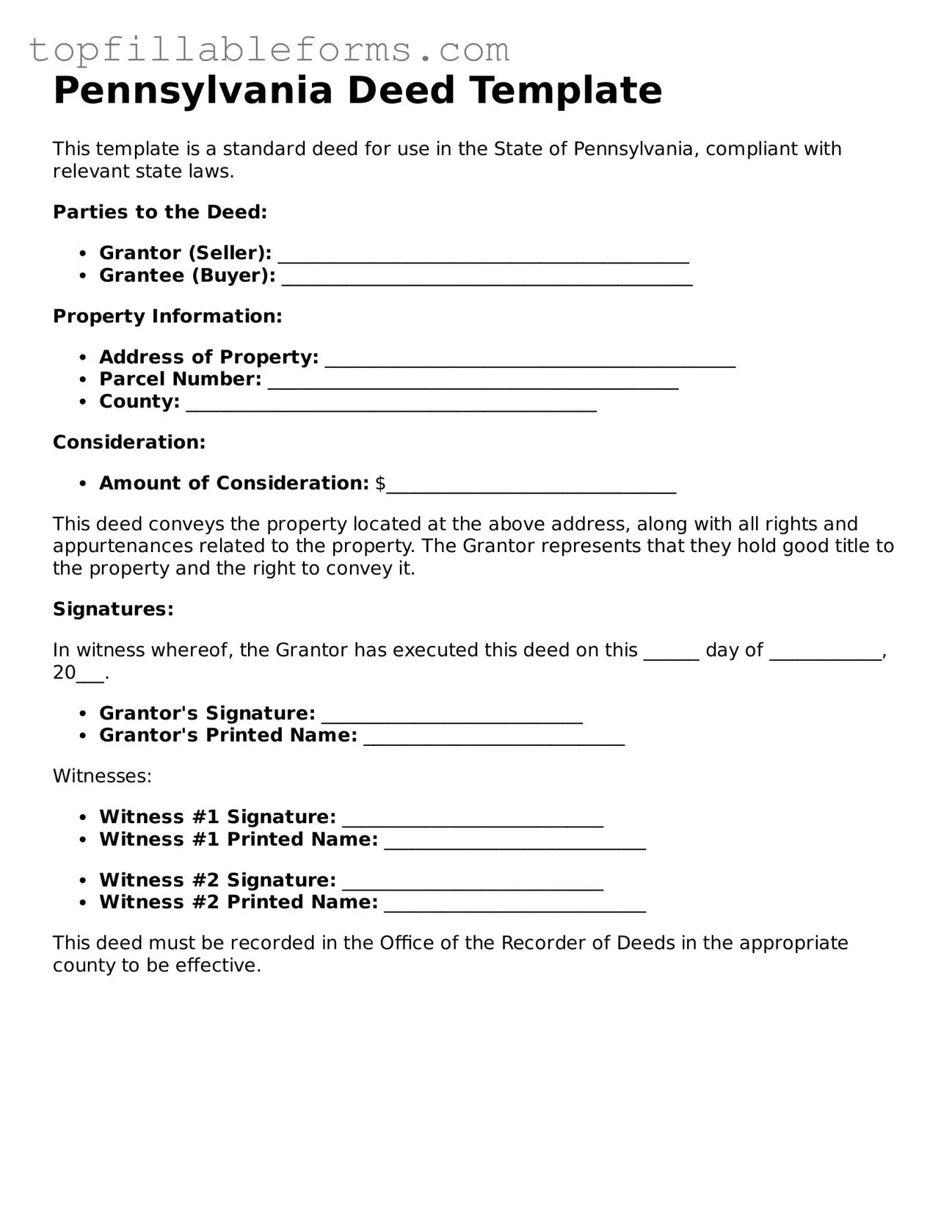

Attorney-Verified Deed Template for Pennsylvania

A Pennsylvania Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines essential details such as the names of the parties involved, a description of the property, and any conditions related to the transfer. Understanding this document is crucial for ensuring a smooth and legally compliant property transaction in Pennsylvania.

Open Deed Editor Here

Attorney-Verified Deed Template for Pennsylvania

Open Deed Editor Here

Finish the form now and be done

Finish your Deed online by editing, saving, and downloading fast.

Open Deed Editor Here

or

▼ PDF File