Attorney-Verified Transfer-on-Death Deed Template for Pennsylvania

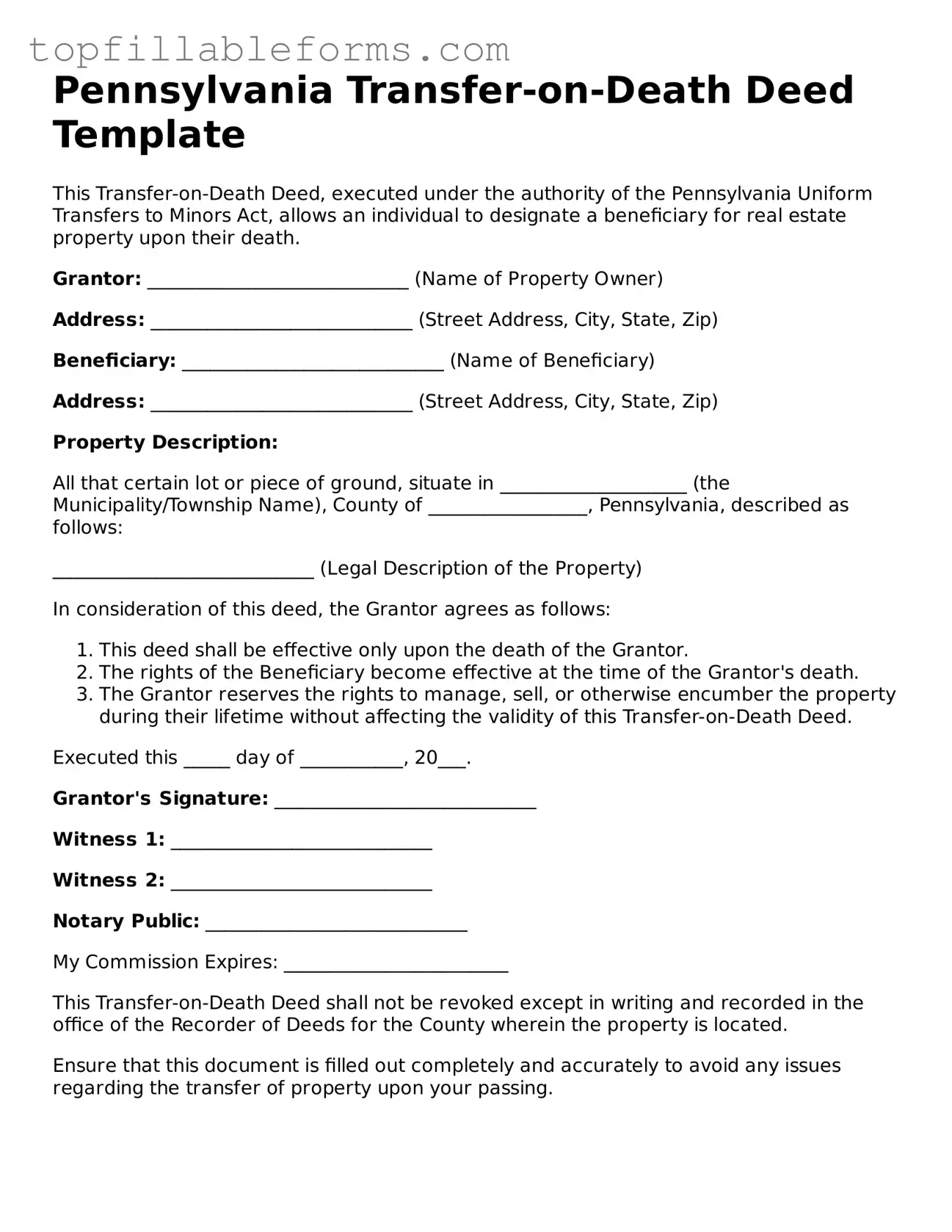

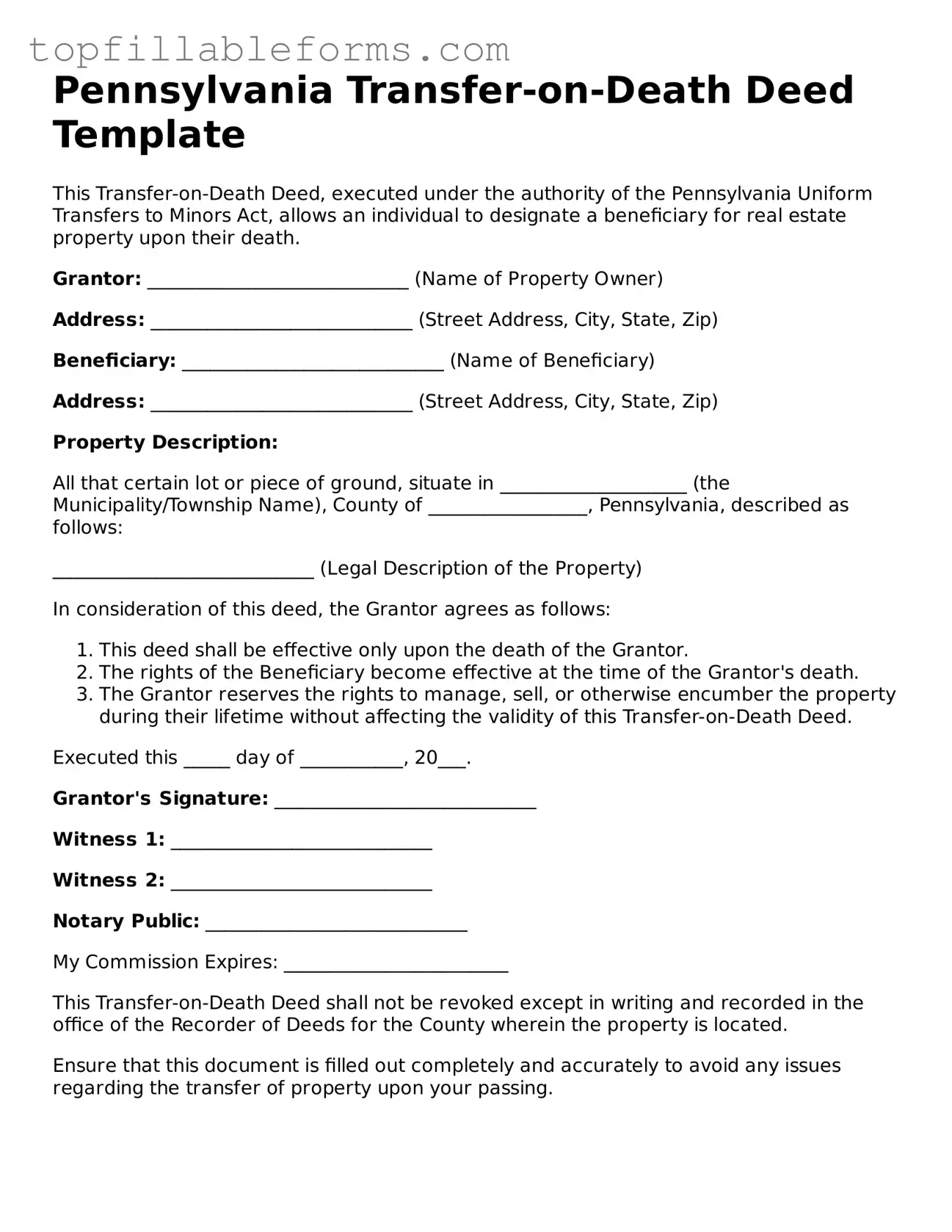

A Pennsylvania Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. This straightforward method helps ensure that your property goes directly to your chosen heirs. Understanding how to use this form can simplify estate planning and provide peace of mind.

Open Transfer-on-Death Deed Editor Here

Attorney-Verified Transfer-on-Death Deed Template for Pennsylvania

Open Transfer-on-Death Deed Editor Here

Finish the form now and be done

Finish your Transfer-on-Death Deed online by editing, saving, and downloading fast.

Open Transfer-on-Death Deed Editor Here

or

▼ PDF File