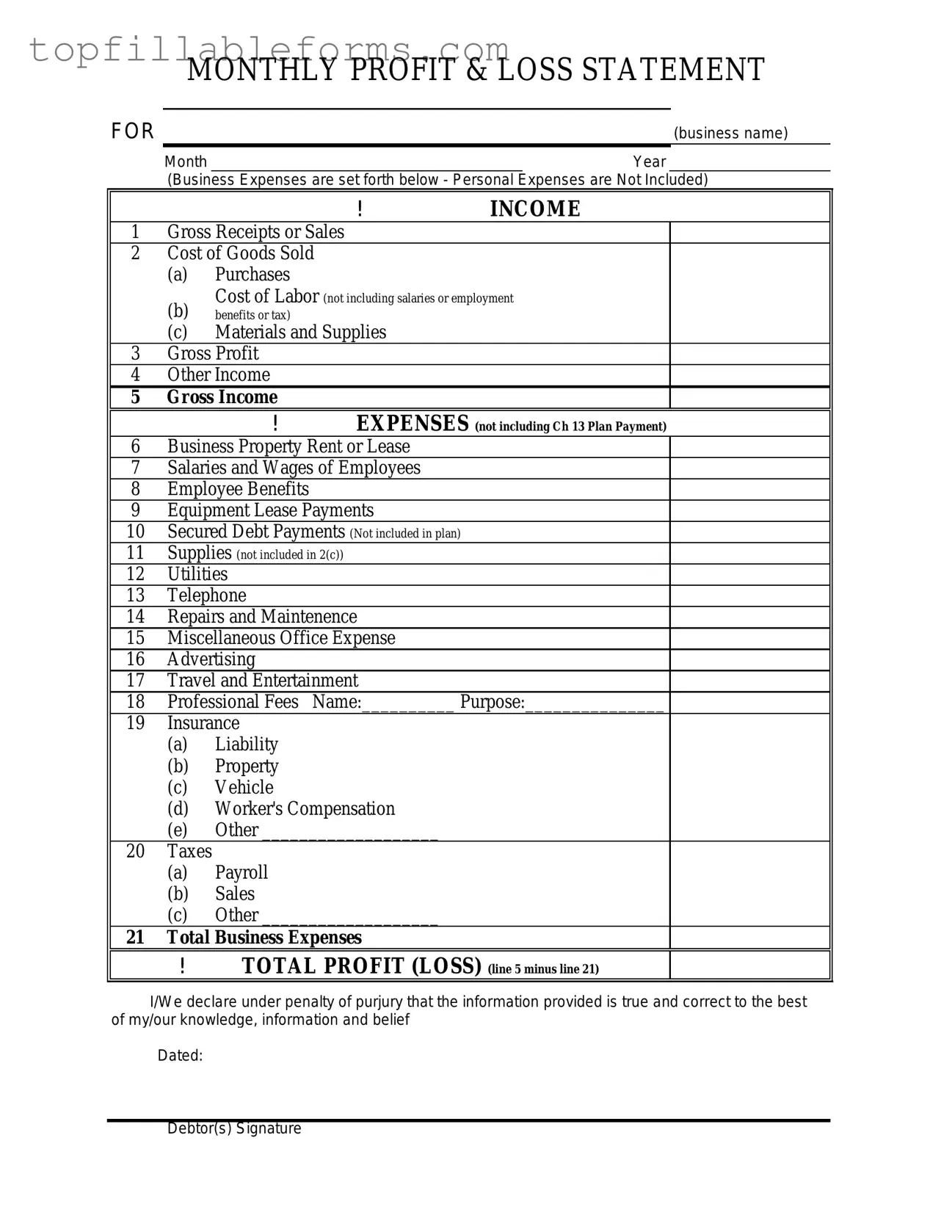

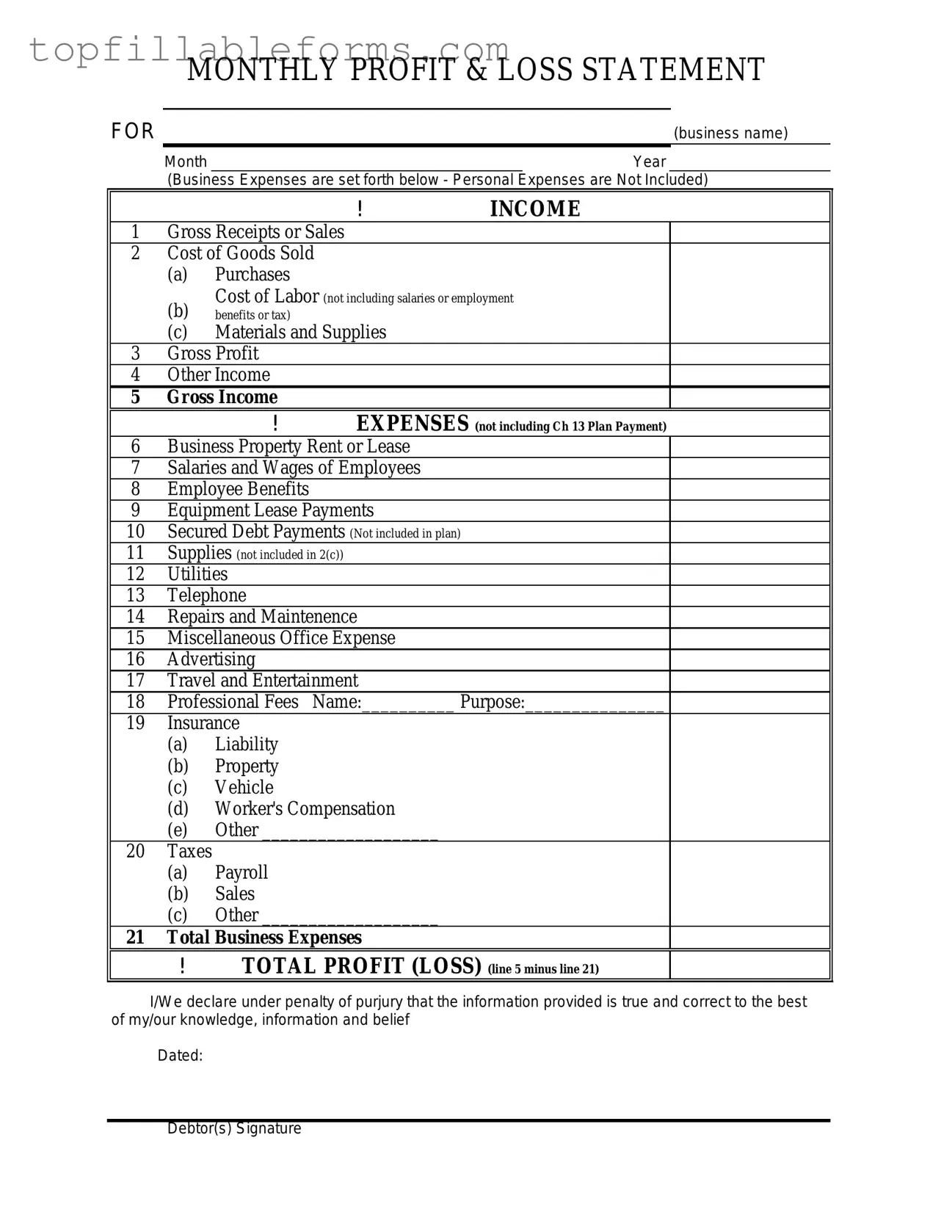

Printable Profit And Loss Form in PDF

The Profit and Loss form is a financial statement that summarizes revenues, costs, and expenses incurred during a specific period. This document provides valuable insights into a company's financial performance, helping stakeholders assess profitability. Understanding this form is essential for effective financial management and decision-making.

Open Profit And Loss Editor Here

Printable Profit And Loss Form in PDF

Open Profit And Loss Editor Here

Finish the form now and be done

Finish your Profit And Loss online by editing, saving, and downloading fast.

Open Profit And Loss Editor Here

or

▼ PDF File