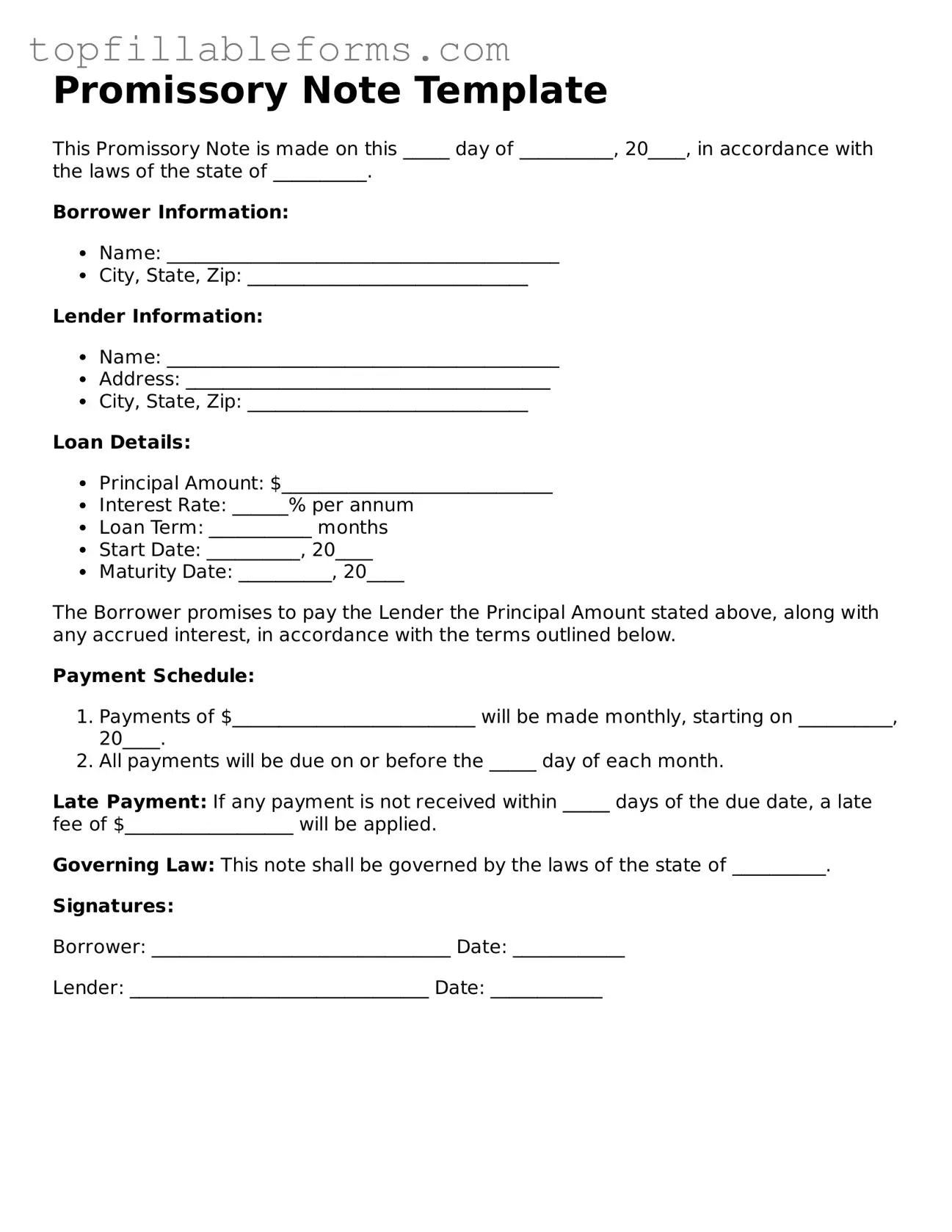

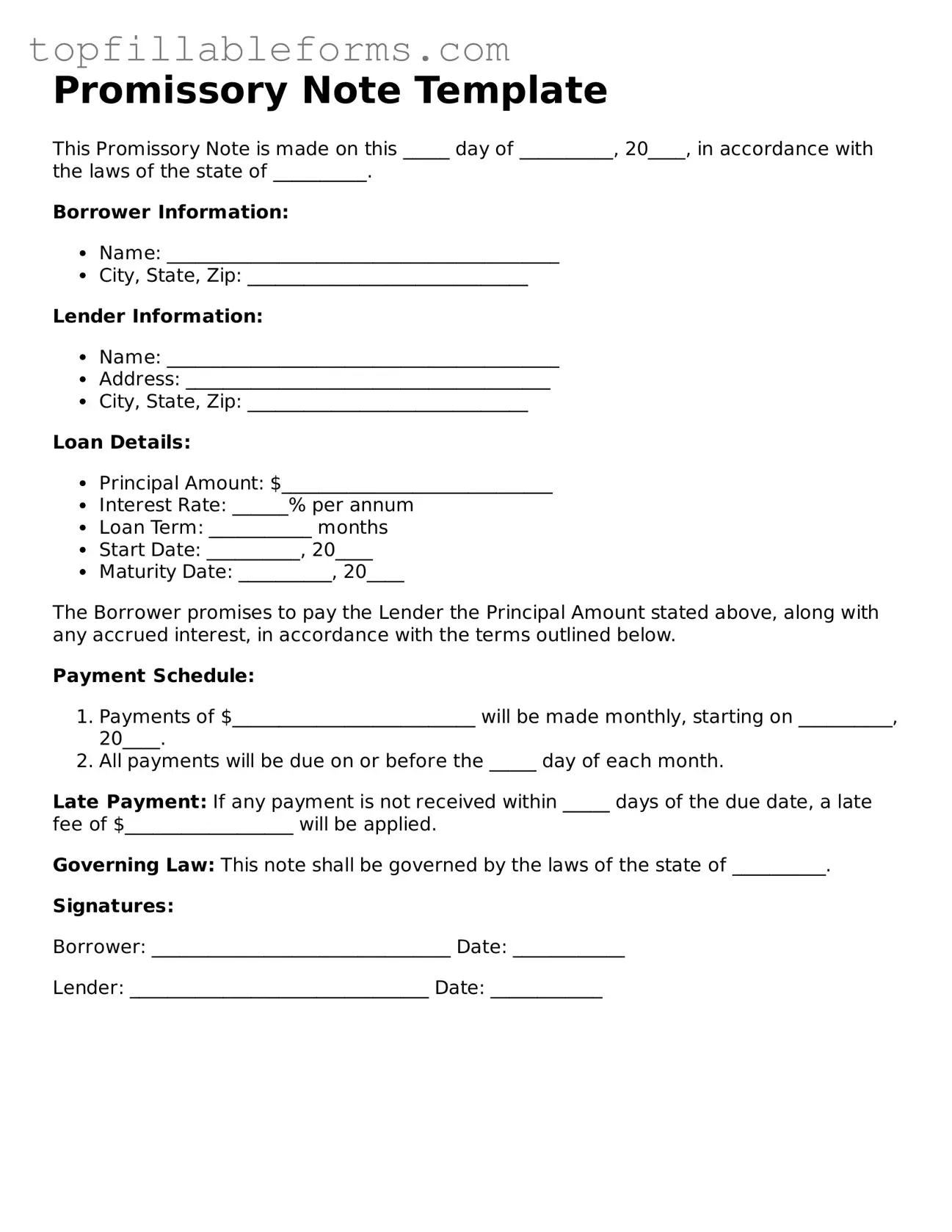

Free Promissory Note Form

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a particular time or on demand. This financial instrument serves as a critical tool in various transactions, providing clarity and security for both the borrower and the lender. Understanding its structure and purpose can significantly enhance one's ability to navigate financial agreements effectively.

Open Promissory Note Editor Here

Free Promissory Note Form

Open Promissory Note Editor Here

Finish the form now and be done

Finish your Promissory Note online by editing, saving, and downloading fast.

Open Promissory Note Editor Here

or

▼ PDF File