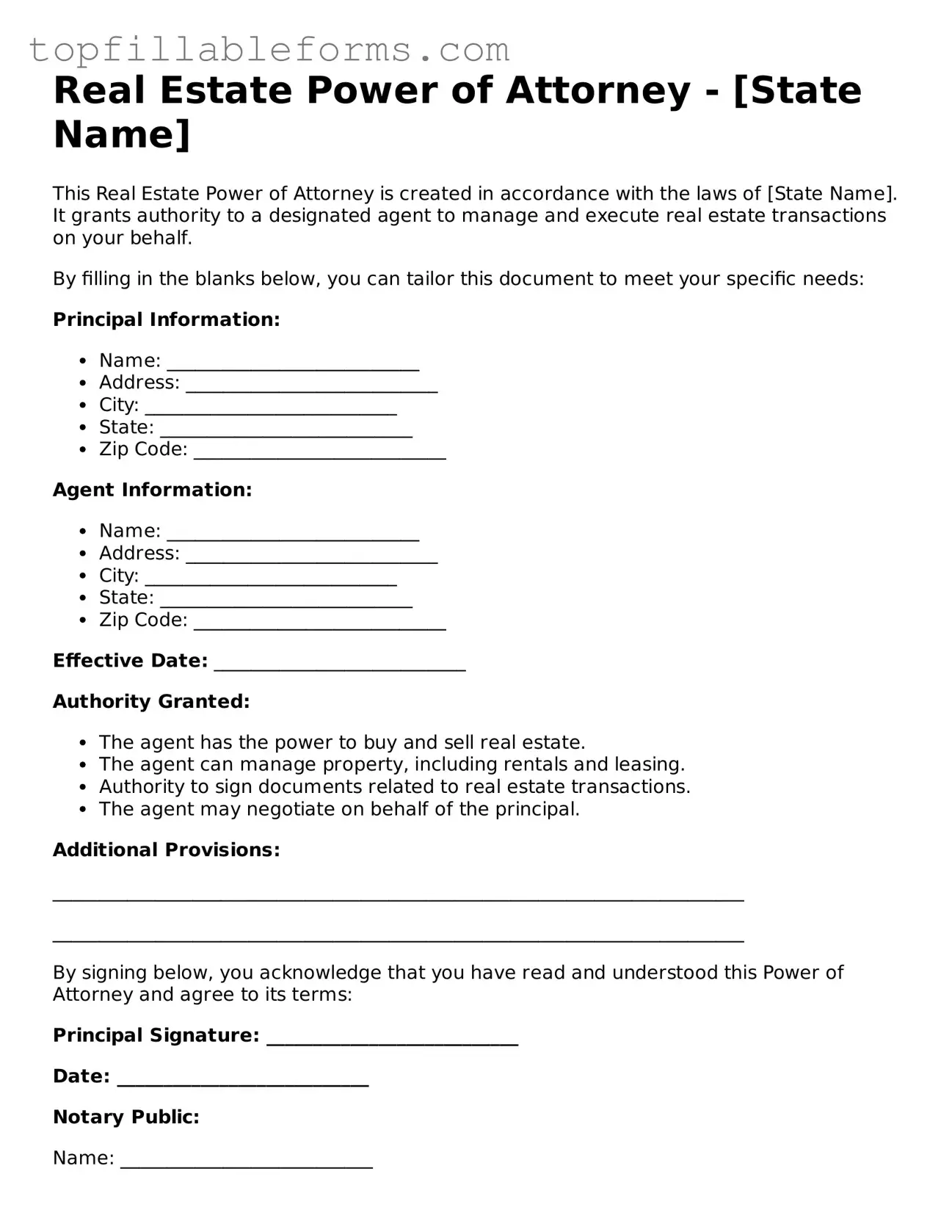

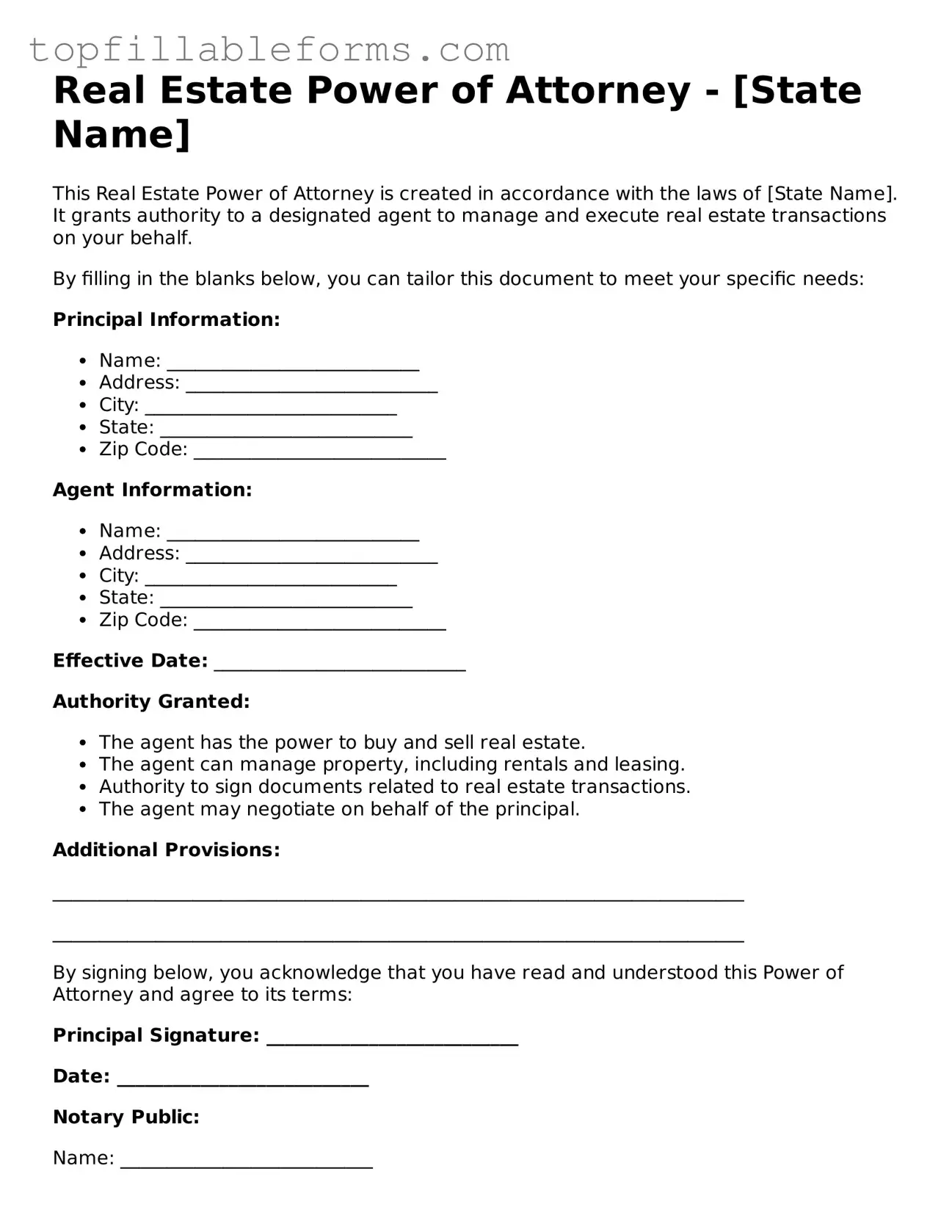

Free Real Estate Power of Attorney Form

A Real Estate Power of Attorney form allows one person to authorize another to act on their behalf in real estate transactions. This legal document grants the agent the authority to make decisions regarding property sales, purchases, and management. Understanding this form is essential for anyone looking to delegate real estate responsibilities effectively.

Open Real Estate Power of Attorney Editor Here

Free Real Estate Power of Attorney Form

Open Real Estate Power of Attorney Editor Here

Finish the form now and be done

Finish your Real Estate Power of Attorney online by editing, saving, and downloading fast.

Open Real Estate Power of Attorney Editor Here

or

▼ PDF File