-

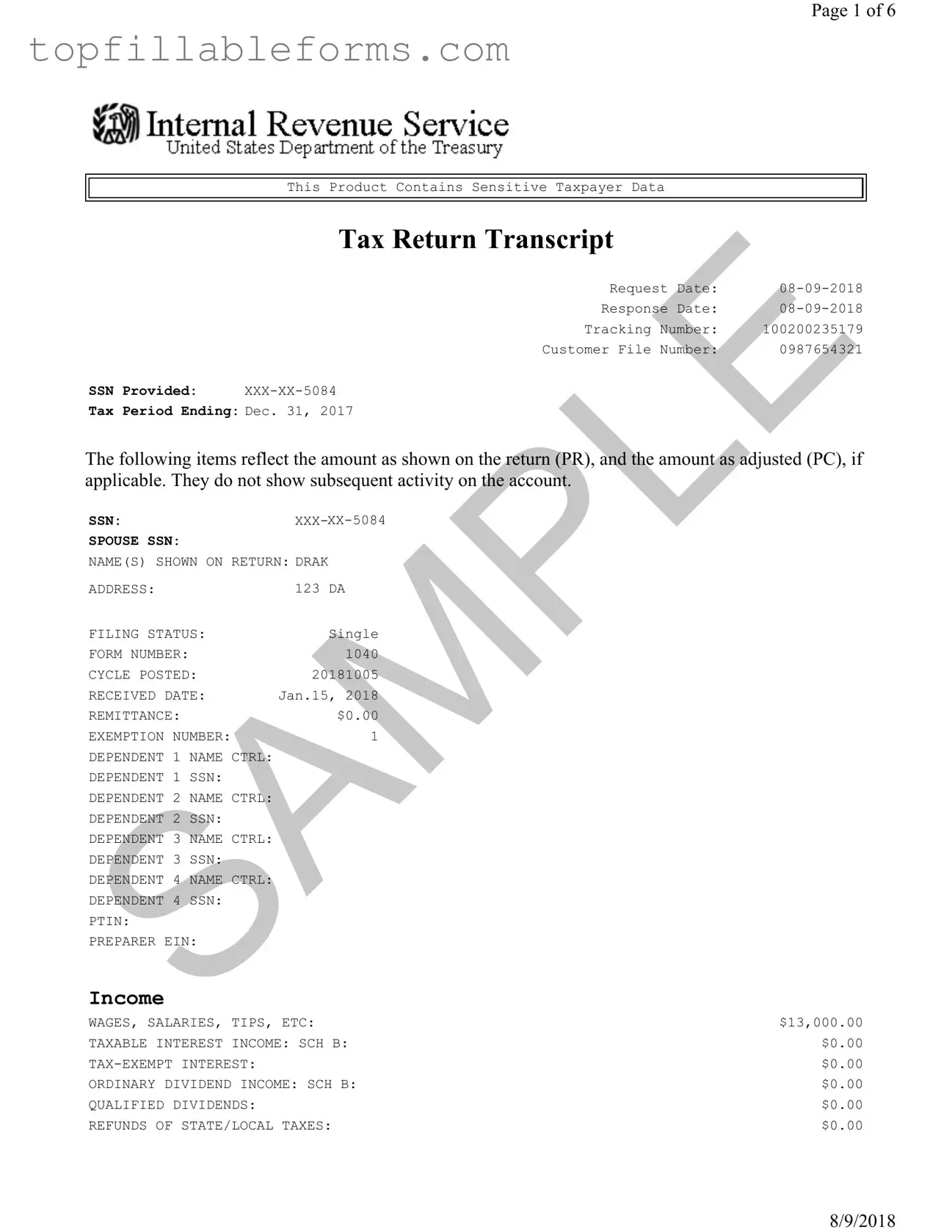

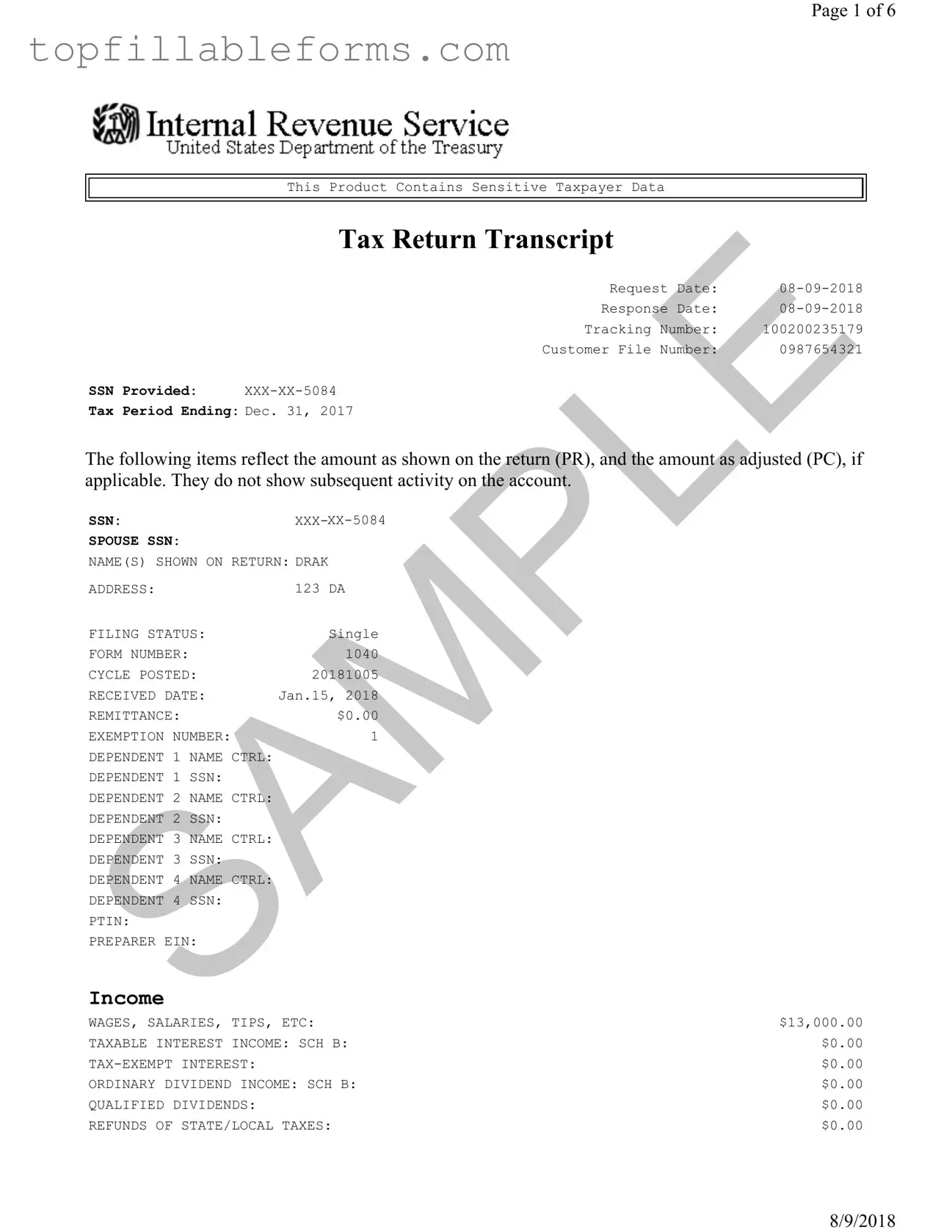

What is a Tax Return Transcript?

A Tax Return Transcript is a summary of your tax return information, as reported to the IRS. It includes most line items from your tax return, such as your income, deductions, and credits. This document is often used for various purposes, including applying for loans or verifying income for government assistance programs.

-

How can I request a Tax Return Transcript?

You can request a Tax Return Transcript online through the IRS website, by phone, or by mailing Form 4506-T. If you choose to request it online, you will need to provide some personal information for verification. If you prefer to do it by mail, make sure to complete the form accurately to avoid delays.

-

Is there a fee to obtain a Tax Return Transcript?

No, there is no fee for requesting a Tax Return Transcript. The IRS provides this service free of charge, whether you request it online, by phone, or by mail.

-

How long does it take to receive my Tax Return Transcript?

Typically, if you request your transcript online or by phone, you can receive it immediately. If you mail your request, it may take up to 10 business days for the IRS to process it and send it to you. Keep in mind that during peak tax season, processing times may be longer.

-

What information is included in a Tax Return Transcript?

A Tax Return Transcript includes your filing status, adjusted gross income, taxable income, and the total tax you owed or refunded. It does not include any additional schedules or forms you may have filed with your return, such as detailed deductions or credits.

-

Can I use a Tax Return Transcript for loan applications?

Yes, many lenders accept a Tax Return Transcript as proof of income when applying for loans. It provides a reliable summary of your financial situation, making it easier for lenders to assess your eligibility.

-

What should I do if I find errors on my Tax Return Transcript?

If you notice any discrepancies between your transcript and your actual tax return, you should contact the IRS immediately. They can help you understand the issue and guide you on the steps to correct it, which may involve amending your tax return.

-

How long does the IRS keep Tax Return Transcripts on file?

The IRS keeps Tax Return Transcripts on file for up to three years from the date you filed your return. If you need information from an older return, you may need to request a copy of the actual return instead.

-

Can someone else request my Tax Return Transcript?

Yes, but they will need your written consent. You can designate a third party to receive your transcript by completing the appropriate section on Form 4506-T. This is often required for lenders or other institutions to access your tax information.

-

What if I need a Tax Return Transcript for a year I didn’t file?

If you did not file a tax return for a specific year, you will not be able to obtain a Tax Return Transcript for that year. If you need proof of income, consider providing other documentation, such as W-2s or 1099s, for the income you earned during that time.