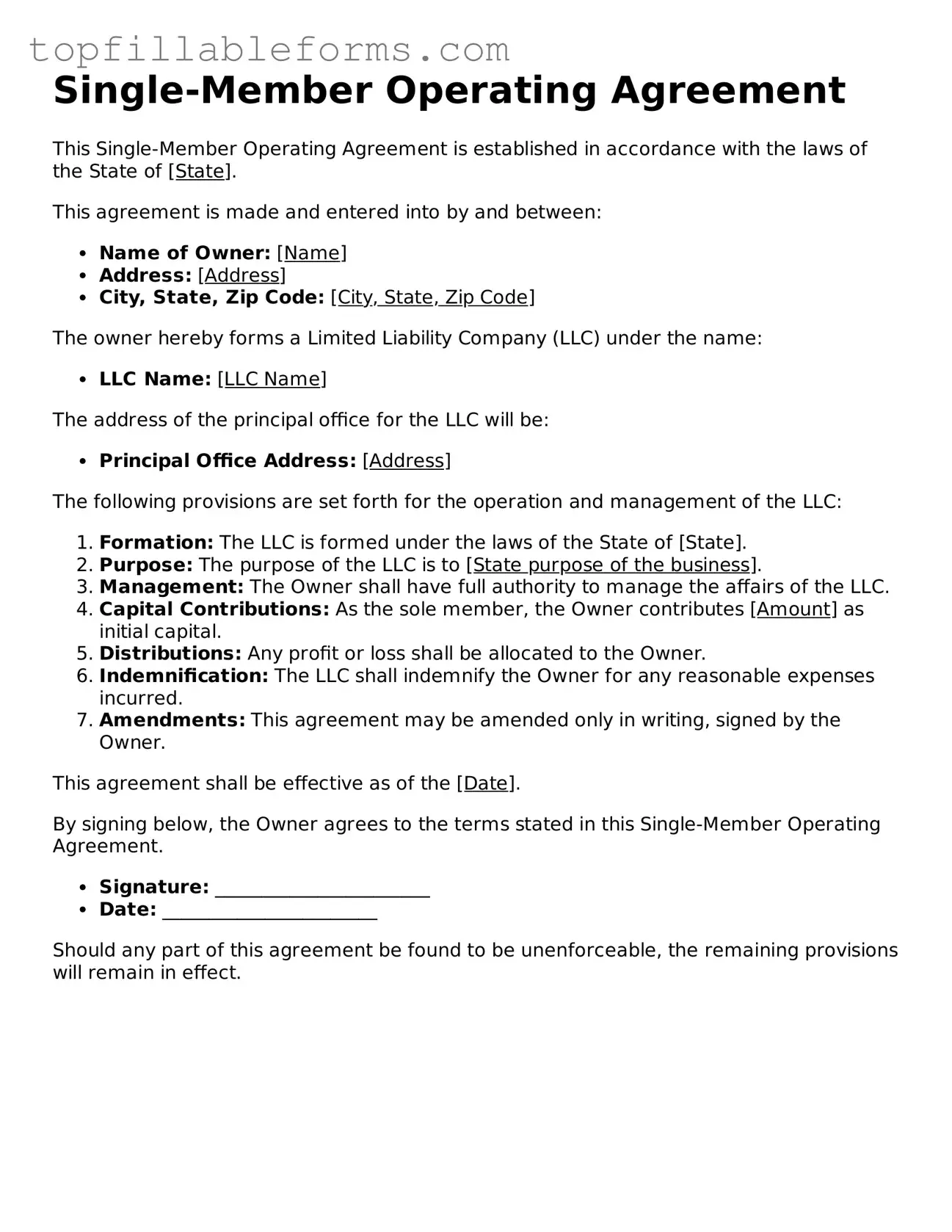

Free Single-Member Operating Agreement Form

A Single-Member Operating Agreement is a crucial document that outlines the management structure and operational guidelines for a single-member limited liability company (LLC). This agreement helps clarify the owner's rights and responsibilities, ensuring that the business operates smoothly. By having a well-drafted agreement, the owner can protect personal assets and establish clear procedures for decision-making.

Open Single-Member Operating Agreement Editor Here

Free Single-Member Operating Agreement Form

Open Single-Member Operating Agreement Editor Here

Finish the form now and be done

Finish your Single-Member Operating Agreement online by editing, saving, and downloading fast.

Open Single-Member Operating Agreement Editor Here

or

▼ PDF File