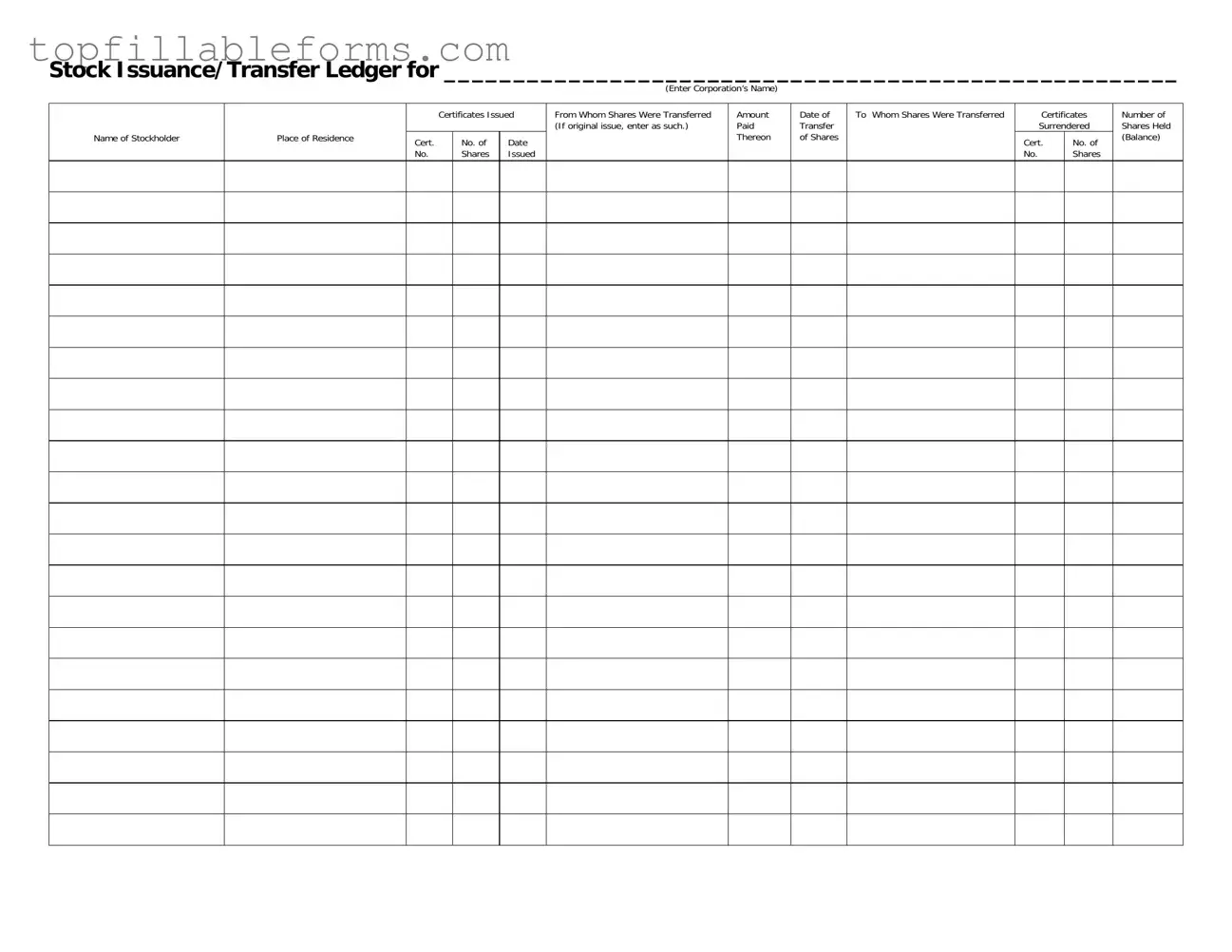

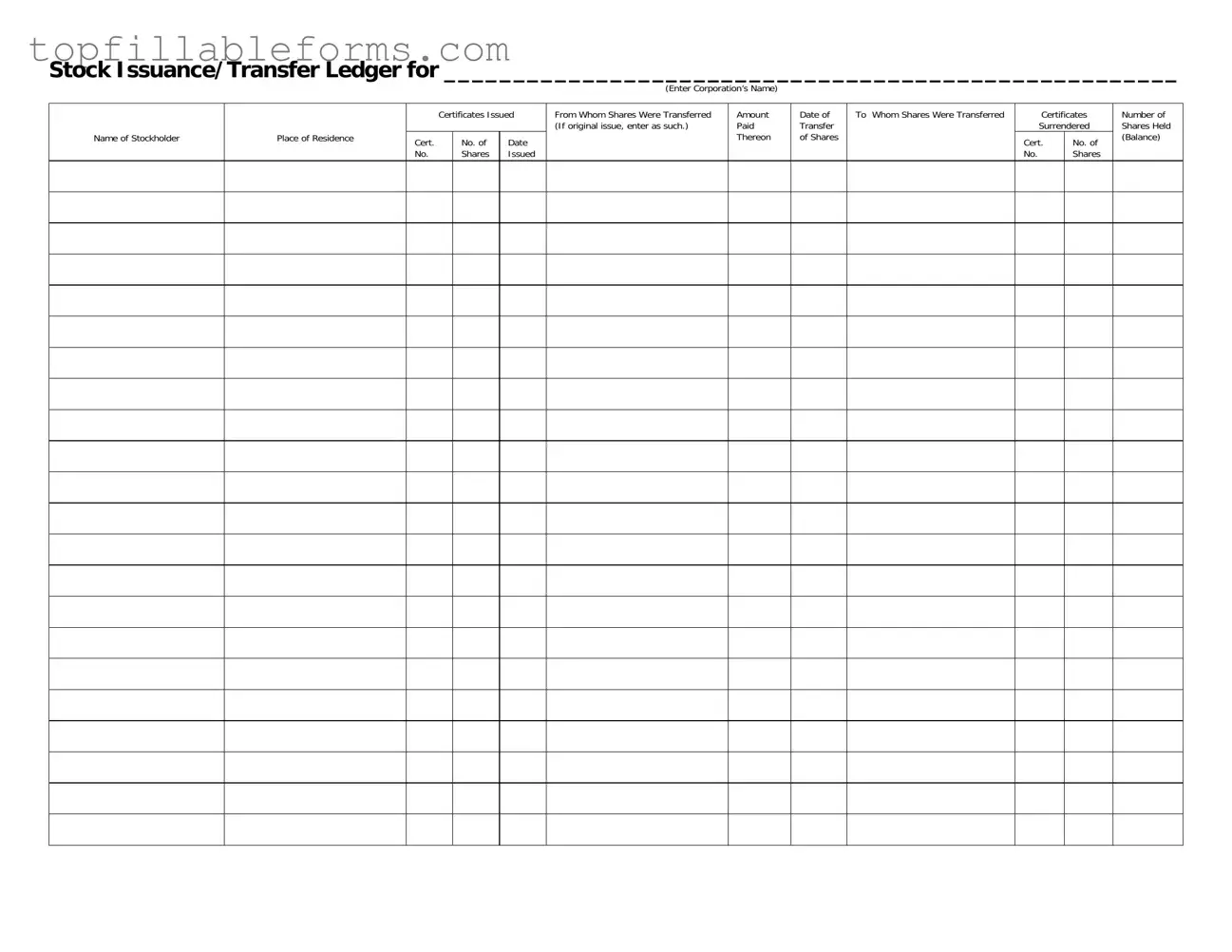

Printable Stock Transfer Ledger Form in PDF

The Stock Transfer Ledger form is a crucial document used to record the issuance and transfer of shares within a corporation. It captures essential information, including the names of stockholders, the certificates issued, and the details of any transfers. This form ensures transparency and accuracy in maintaining a corporation's stock records, which is vital for both legal compliance and shareholder communication.

Open Stock Transfer Ledger Editor Here

Printable Stock Transfer Ledger Form in PDF

Open Stock Transfer Ledger Editor Here

Finish the form now and be done

Finish your Stock Transfer Ledger online by editing, saving, and downloading fast.

Open Stock Transfer Ledger Editor Here

or

▼ PDF File