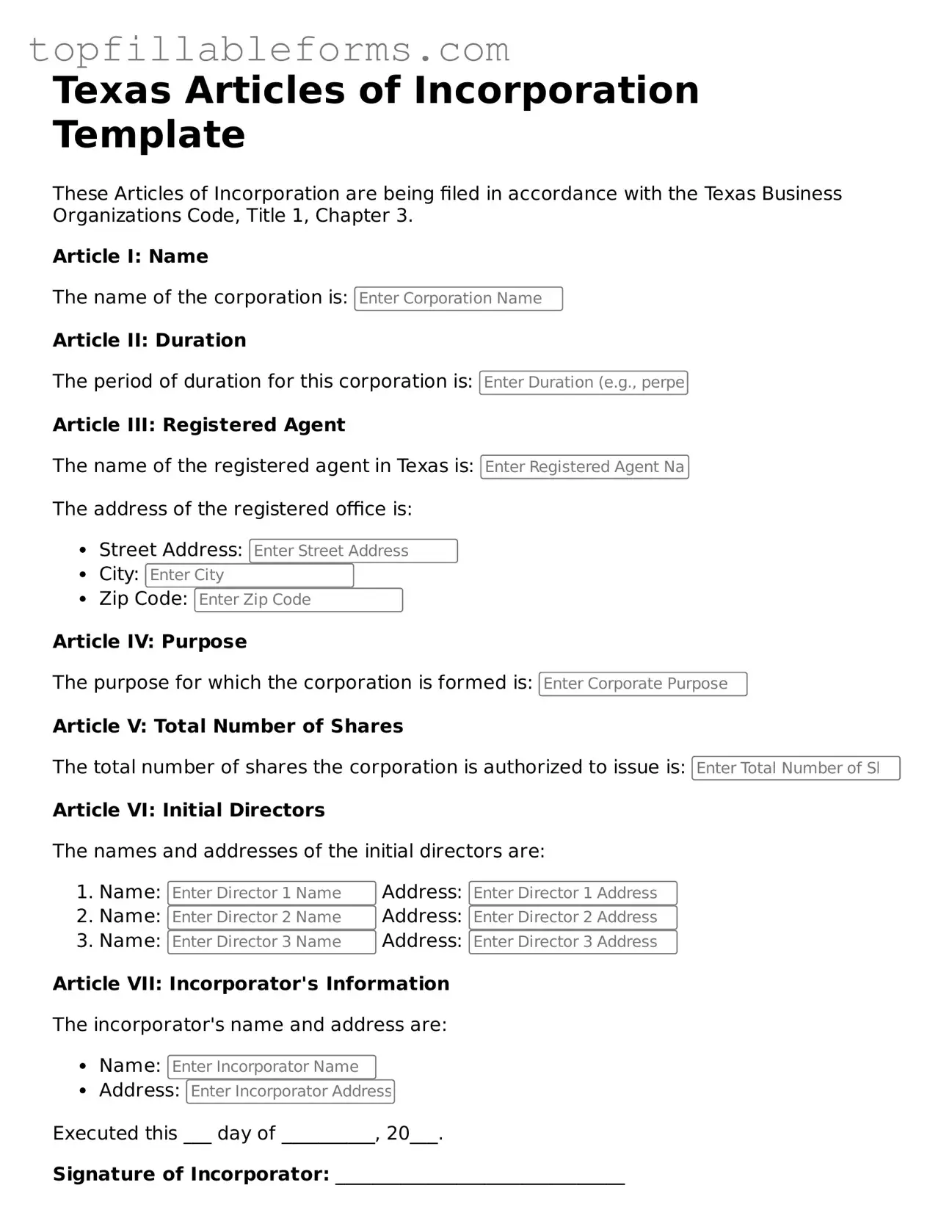

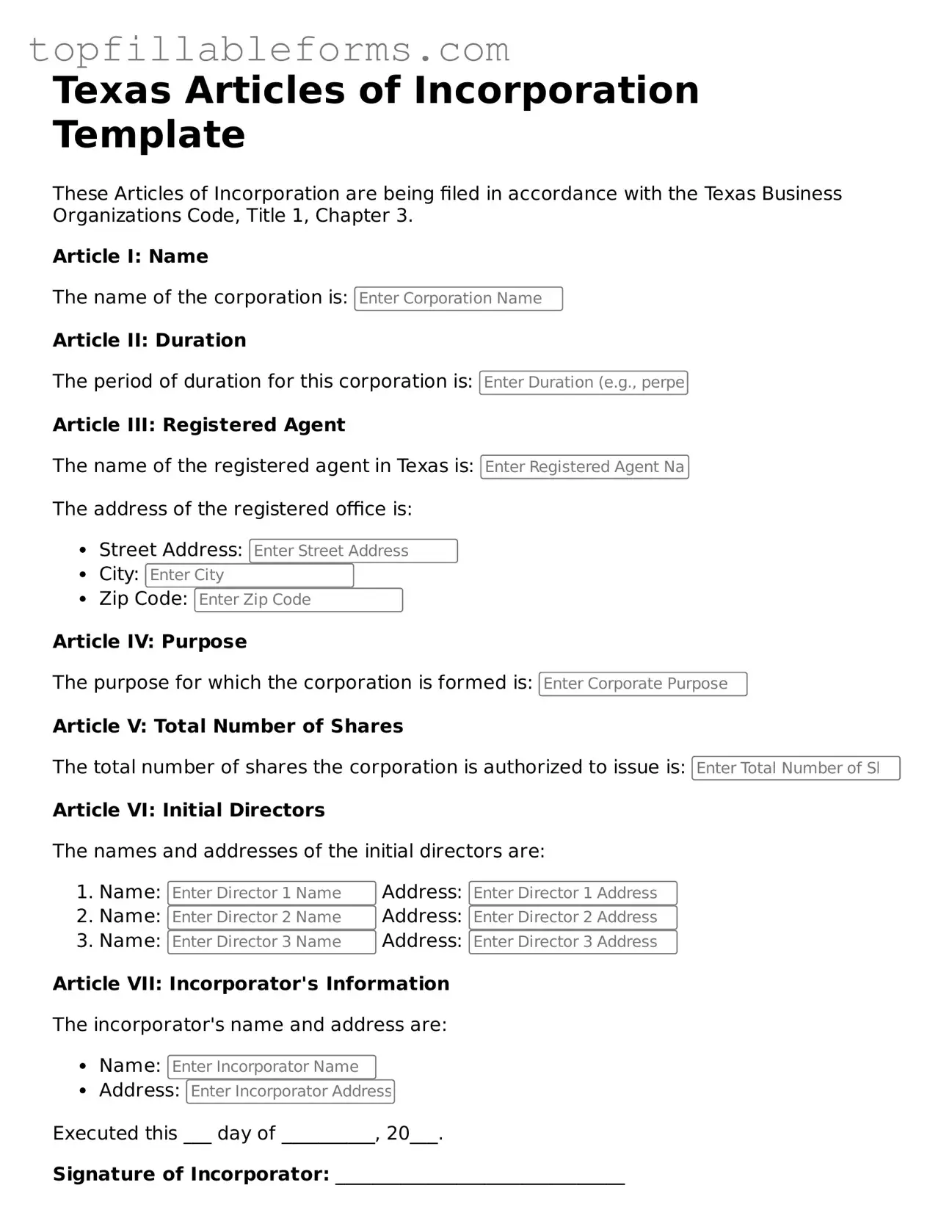

Attorney-Verified Articles of Incorporation Template for Texas

The Texas Articles of Incorporation form is a legal document used to establish a corporation in the state of Texas. This form outlines essential details about the corporation, such as its name, purpose, and the structure of its management. Completing this form is a crucial step for anyone looking to start a business in Texas.

Open Articles of Incorporation Editor Here

Attorney-Verified Articles of Incorporation Template for Texas

Open Articles of Incorporation Editor Here

Finish the form now and be done

Finish your Articles of Incorporation online by editing, saving, and downloading fast.

Open Articles of Incorporation Editor Here

or

▼ PDF File