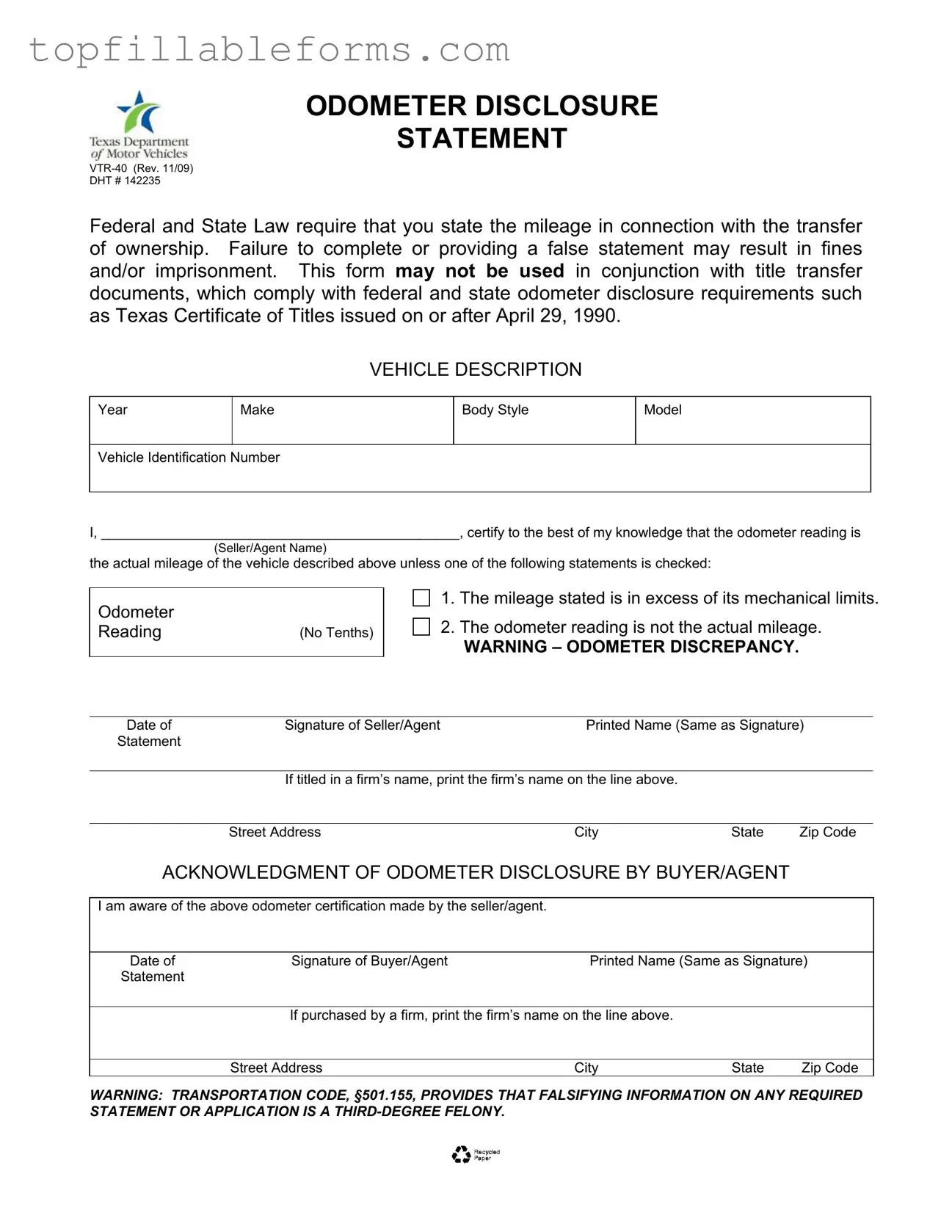

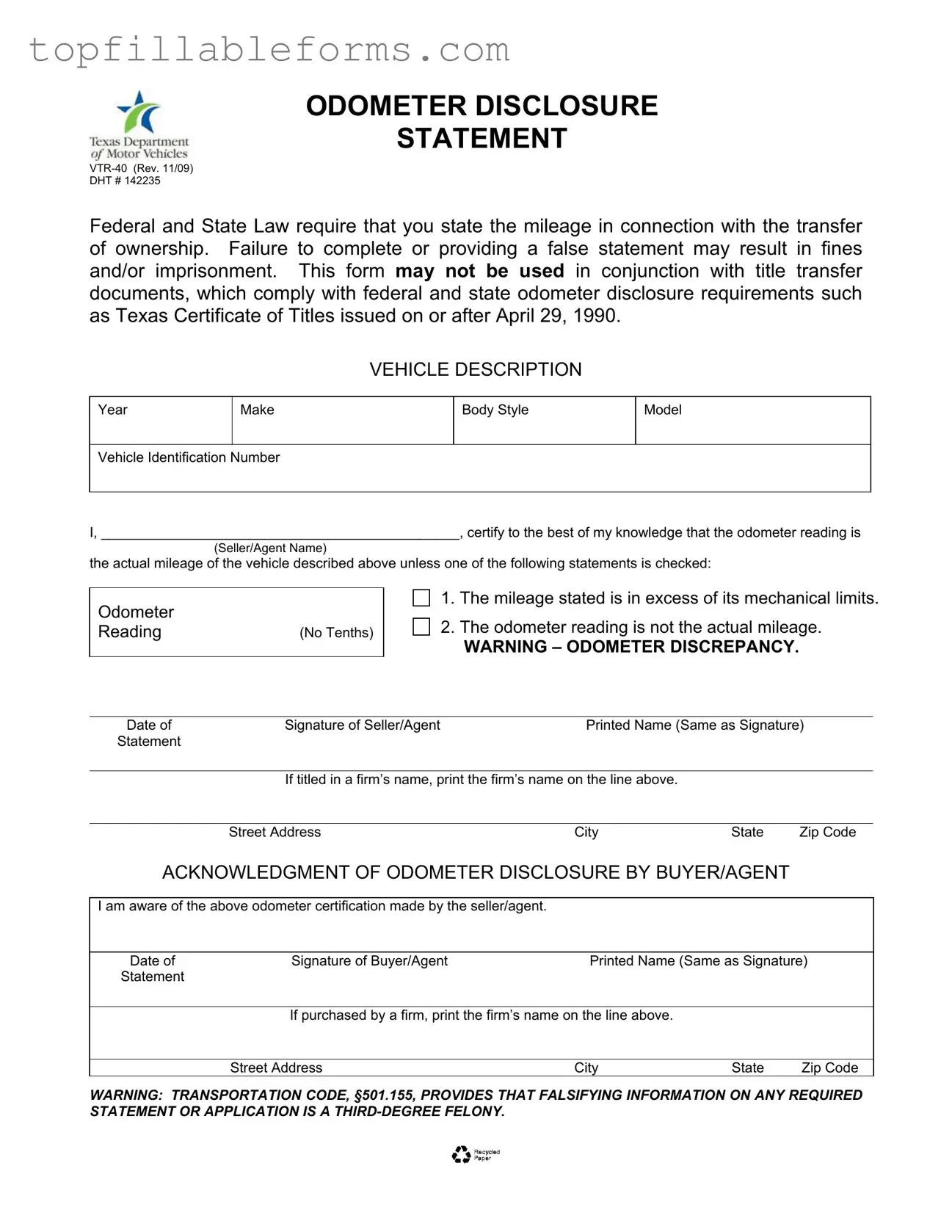

Printable Texas Odometer Statement Form in PDF

The Texas Odometer Statement form is a legal document required during the transfer of vehicle ownership, ensuring that the mileage of the vehicle is accurately disclosed. Compliance with federal and state laws is essential, as providing false information may lead to severe penalties, including fines or imprisonment. This form is distinct from title transfer documents and plays a crucial role in protecting both buyers and sellers in the transaction process.

Open Texas Odometer Statement Editor Here

Printable Texas Odometer Statement Form in PDF

Open Texas Odometer Statement Editor Here

Finish the form now and be done

Finish your Texas Odometer Statement online by editing, saving, and downloading fast.

Open Texas Odometer Statement Editor Here

or

▼ PDF File