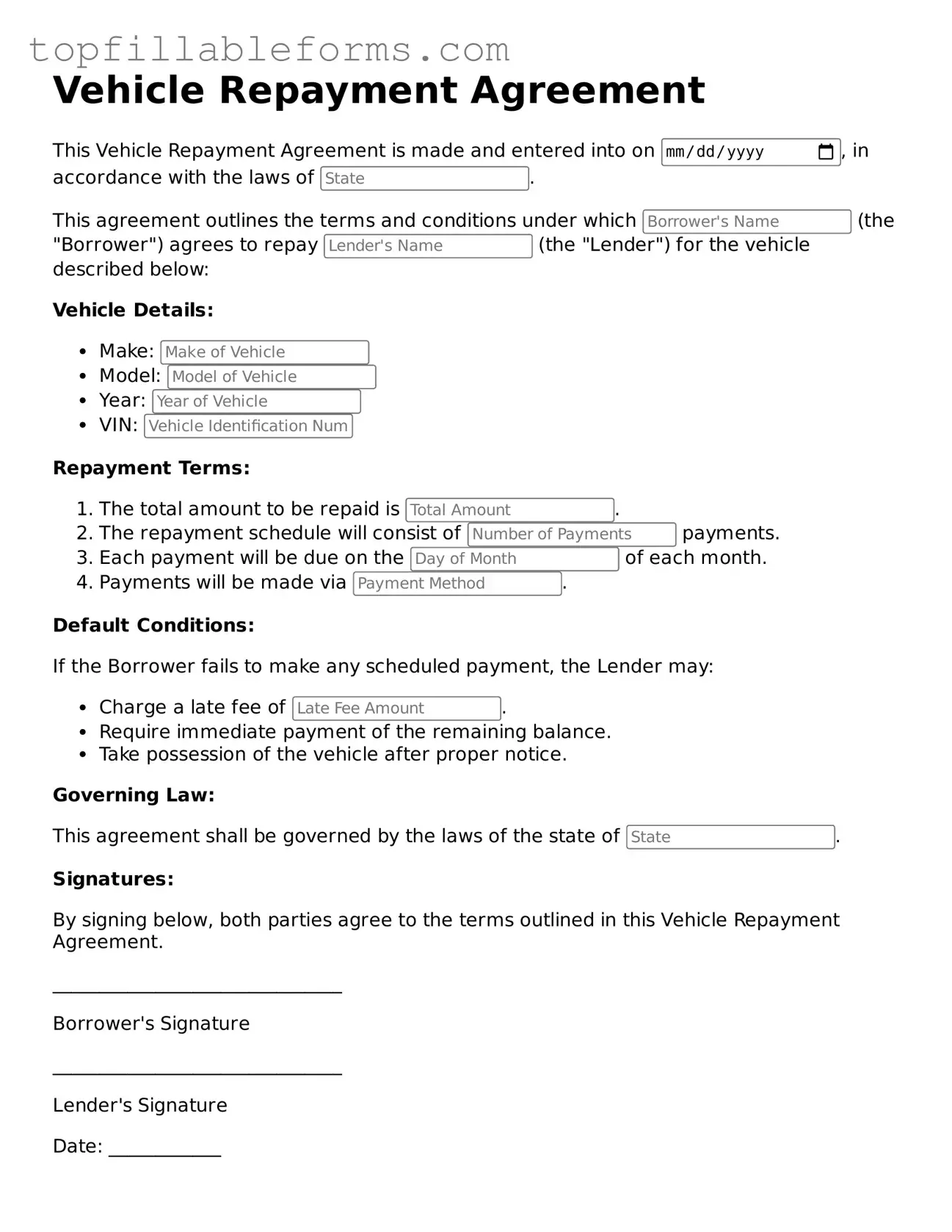

Free Vehicle Repayment Agreement Form

The Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. This agreement protects both the lender and the borrower by clearly defining payment schedules, interest rates, and consequences for default. Understanding this form is essential for anyone financing a vehicle, ensuring that all parties are on the same page regarding their financial responsibilities.

Open Vehicle Repayment Agreement Editor Here

Free Vehicle Repayment Agreement Form

Open Vehicle Repayment Agreement Editor Here

Finish the form now and be done

Finish your Vehicle Repayment Agreement online by editing, saving, and downloading fast.

Open Vehicle Repayment Agreement Editor Here

or

▼ PDF File